Global payments and cash complexity simply managed.

Control global payments, optimize cash management

and reduce compliance risks from one easy-to-use SaaS platform.

Centralize Banking

for Greater Control

& Lower Costs

Standardize local payment processes, improve operational efficiency and reduce costs by overseeing local banking activity from one centralized system.

“TIS is ideal for us. We only have to operate one channel instead of the 15 various eBanking tools used to date.”

Archroma

See Archroma case study

Make Best use of

Your Cash

Improve cash liquidity, reduce borrowing costs and optimize

cash use for investments with full visibility of global cash and precise, automated forecasts.

“Since its setup, it has led to millions of dollars in savings.”

Dawn Foods

See Dawn Foods case studyReduce Fraud and

Compliance Risks

Minimize the fraud, audit and compliance risks of disjointed payment operations with clear oversight of global payments and cash flows.

“With TIS, we’ve achieved a new level regarding control and compliance.”

Heidelberger Druckmaschinen

See Heidelberg case study

Providing you with the insights to empower and the tools to act.

Tis Platform

Unlimited Scale

Manage multiple regions, subsidiaries and banks from one platform.

Unrivalled Bank & Format Coverage

Largest format library on the market and connectivity to 11k+ banks worldwide.

Universal Adoption

Easy-to-use system and speedy onboarding for local finance teams.

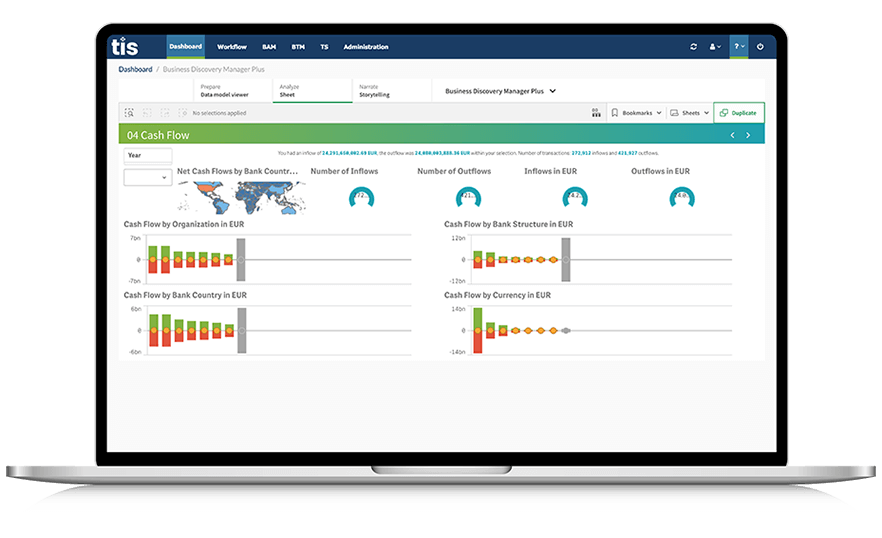

Unprecedented Treasury Control

All global payments & cash visible from one global system.

Extensive Bank Connectivity & Formatting

Overcome connectivity complexity and accelerate new bank onboarding with TIS’ unmatched global bank connections and out-of-the-box format library.

Local Team Adoption

Effortlessly onboard local finance teams to TIS’ user-friendly system, reduce costly configuration efforts and improve agility during ERP migrations, M&A and expansion.

Specialist Partner

Our in-house experts provide tailored support to your finance specialists and free up your IT resources by maintaining the payments infrastructure.

Why Treasurers Need TIS

Control local banking, optimize cash use and strengthen compliance – from one central system.

70%

Less time on cash forecasting

– TomTom

>$10M

Annual saving with TIS

-Unilever