Control global payments. Optimize cash use. Reduce compliance risk.

TIS cloud-based and customizable solutions enable treasurers of multinational corporations to overcome global payments & cash complexity.

Control Global Payments

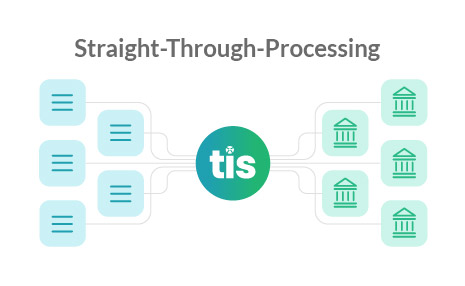

The TIS Payments Hub enables treasurers to manage multiple banks, ERPs, regions and formats – from one centralized system.

Global Payments

Execute global payments efficiently with automated transactions and standardized local banking processes.

US Payments

Optimize US payment routing by using partners’ preferred payment methods to complete transactions (i.e. check, ACH, wire or virtual card) and earn rebates.

FX Payments

Control your global FX exposure by accessing 140+ currencies across 170+ local markets.

Bank Connectivity

TIS provides over 11,000 bank connect options for our clients through a variety of channels including SWIFT, API, SFTP, & EBICS. We also maintain 2,700+ direct bank connections.

Workflows & Approvals

TIS offers complete flexibility for clients to structure payment approvals and workflows in any manner necessary, including multi-signer and multi-system configurations.

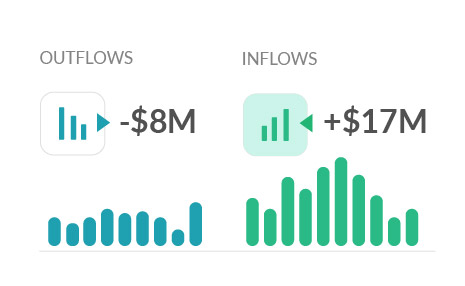

Optimize Cash Use

TIS cash management solutions enable treasurers to improve cash liquidity, reduce borrowing costs, free up cash for investments and simplify cash forecasting.

Bank Account Mgmt

Control all local banking activity, oversee bank account data and streamline bank reporting.

Bank Statement Mgmt

Optimize US payment routing by using partners’ preferred payment methods to complete transactions (i.e. check, ACH, wire or virtual card) and earn rebates.

Balance Reporting

Easily analyze bank account balances with dashboard metrics and create custom reports.

Cash Positioning

Easily view cash positions in near real-time with granular analyses available by bank, region, currency, country, entity, and more.

Reduce Compliance Risk

TIS security and compliance solutions enable treasurers to reduce fraud risk, simplify auditing and enhance regulatory & sanctions compliance.

Sanctions Screening

Screen and monitor all payments according to selected and customizable sanctions lists (i.e. OFAC, EU, UN).

Payment Compliance

Ensure global payments and banking compliance by standardizing and automating local banking processes.

Fraud Prevention

Spot duplicate payments and prevent fraudulent behavior with multifaceted security tools and clear oversight of global transactions.

System & User Audits

TIS serves as a single source for managing alerts and resolutions related to the compliance and security of payments, bank accounts, user actions, and financial data.

Alert Management

TIS maintains compatibility with virtually every financial messaging format in use for both payments and reporting, including SWIFT MT, ISO 20022, and more.

Workflow Control

Easily manage bank accounts, signer information, and user credentials and approvals through an easily configurable and customizable platform.

Learn More

“The support we received from TIS over the course of this project was instrumental to its overall success, and the outcomes in terms of time-to-implement and return-on-investment.”

GE Vernova

Read the Success Story

“The most important aspects which led us to choose TIS were the adaptability and flexibility they offer. They were not only able to react to our specific needs, they also combine several other important treasury services in one integrated platform.”

Boehringer Ingelheim

Read the Success Story

“With TIS, we have now implemented a solution that allows us to manage our extraordinary payment volumes much more efficiently. At the same time, we have harmonized our processes. Not only has the Treasury benefited, but also AP and AR.”

United Internet

Read the Success Story

“The In-house Bank we built based on SAP® APM and with the help of TIS has set a new benchmark in terms of automation and visibility of cashflows and payments. It allowed us to close down approximately 800 bank accounts. This whole project would not have been successful without the innovation skills and flexibility of TIS.”

Siemens Gamesa

Read the Success Story

“With a strong sense of teamwork and effective collaboration between TIS, Unilever and the banks, we achieved success seamlessly navigating times and unlocking opportunities, even without extensive IT support.”

Unilever

Read the Success Story

“Thanks to the TIS SAP® Add-on, switching from R3 to S4/HANA did neither impose significant challenges on our TIS setup nor did it require heavy IT involvement. The new connectivity via the TIS Add-on could simply be established by setting a few configurations. Our current processes run equally speedy and smooth.”

The Bahlsen Family

Read the Success Story

“TIS is now our central hub to our banks. Even in countries with highly complex financial and banking landscapes, we now benefit from unified, audit-proof processes, full transparency over accounts and balances, and seamless data transmission between back-office systems and banks. This ensures exactly the efficiency gains and risk minimization we were hoping for.”

Draxlmaier

Read the Success Story

“TIS provides us with a sophisticated yet easy-to-integrate cloud-based solution that provides end-to-end bank information and transaction management through a single platform. The embedded business intelligence feature is a powerful reporting tool that supports C-level reporting and makes tasks such as the FBAR (Foreign Bank Account Report) process easier and less resource intensive.”

ifaw

Read the Success Story