IT leaders worldwide are seeking to embrace digital transformation…

…and most organizations are already actively leveraging cloud technology. However, global firms dealing with multiple banking, payments, and financial systems still face a myriad of technology-centric obstacles. This is especially the case when establishing end-to-end connectivity and attempting to provide stakeholders with seamless data integration and cash flow visibility.

Common challenges for IT regarding treasury & finance technology:

Disparate bank connect options

create complexity when trying to integrate each channel with the back-office.

Siloed back-office ERPs and TMSs

create gaps with information reporting and data visibility.

Insufficient service & support

from external technology vendors and consultants.

Introducing the Award-Winning TIS Cloud Platform & Service

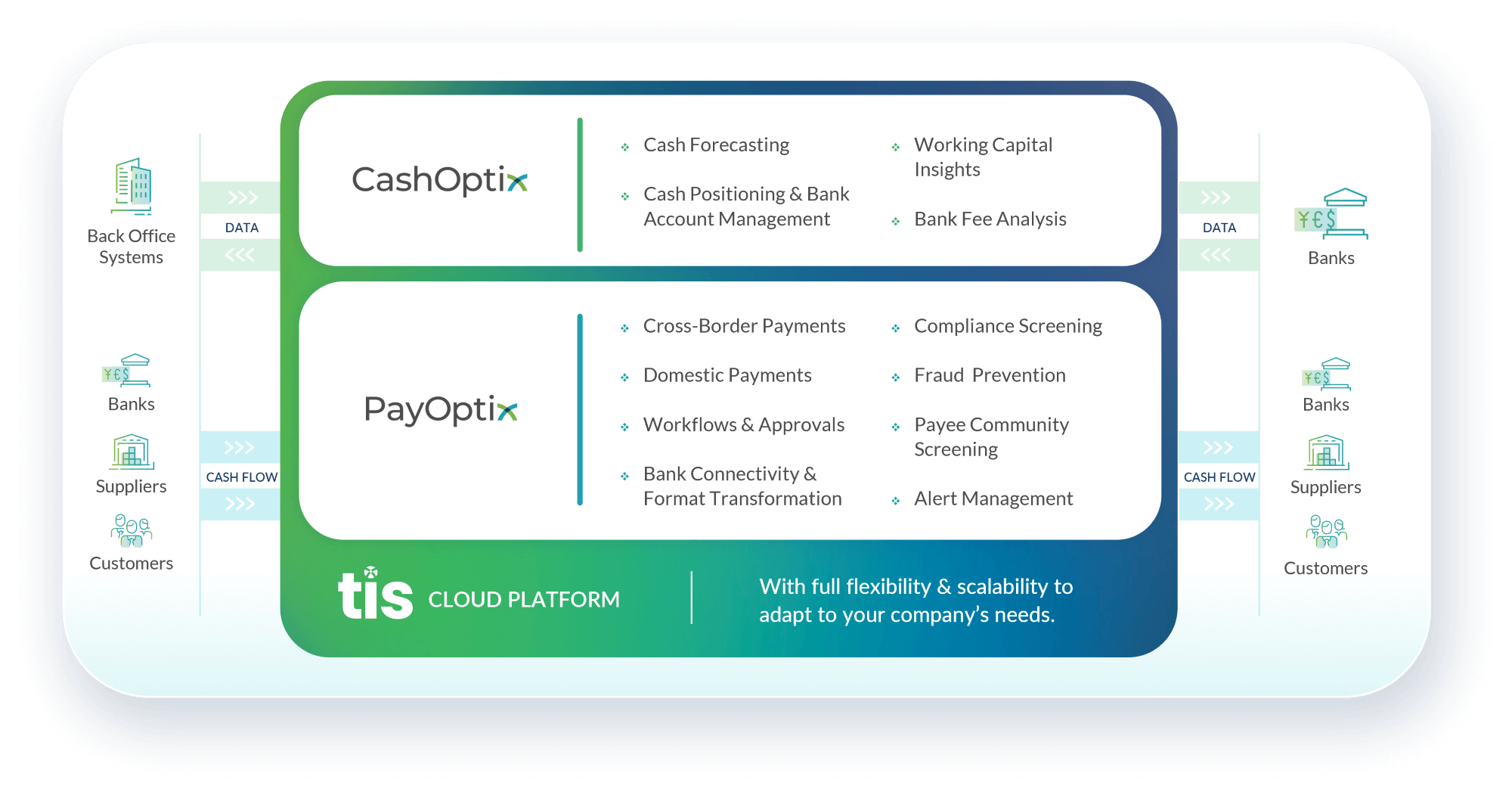

Our goal at TIS is to help clients gain full control and visibility over their global payments, banking, and liquidity workflows. As part of this commitment, TIS has developed a best-in-class approach to client success that ensures all our global users receive the best possible onboarding, training, and support throughout their journey. From the time organizations first engage with TIS onwards, our team of experts work tirelessly to ensure operations run smoothly and without interruption.

By using true cloud technology in a SaaS deployment, you benefit from fast implementation and automated software updates, eliminating IT overhead and reducing deployment complexity. We offer powerful digital tools and training to help your teams streamline existing processes and optimize data access across the enterprise.

2.5K+

integrated back-office systems

11K+

global bank connect options

85K+

client bank accounts connected

9.1+

stars for exemplary support & service

99.9%+

annual system uptime

100%

cloud-native technology

The Value of TIS for IT Leaders

Enterprise IT teams are largely freed from their responsibility with implementations and ongoing systems maintenance with TIS. Because our platform is fully cloud-based and all core onboarding tasks are managed by TIS’ expert team, internal IT staff spend only a fraction of the time they’d traditionally dedicate to financial technology projects.

In addition, TIS manages connectivity with back-office systems and banks on our clients’ behalf, which further reduces the workload for IT. Our 99.95%+ annual uptime, 45+ releases per year, and continuous updates to our extensive payment format library provide the continuity needed to maintain business processes 24/7, while our fully-managed hosting and data storage services ensure your information is always kept safe, secure, and compliant.

Standardize & Automate

global bank account and payments data through a single source

Make strategic decisions

based on reliable insights from real-time connectivity flows

Reduce security risks

by increasing transparency and standardizing compliance workflows

Integrate the full back-office

with TIS’ intuitive system configuration and exemplary support

Maximize bandwidth for other projects

by relying on the TIS team for system maintenance and configuration

Ensure global visibility and control

over critical financial data for company-wide stakeholders

What capabilities does TIS provide to organizations?

Over a decade of proven client results

Leaders with a broad array of digital transformation challenges have leveraged TIS expertise and technology to achieve successful project results.

Trusted by 35,000+ Professionals in 140+ Countries

The TIS platform is actively leveraged by over 35,000 users across numerous Fortune 500 companies and multinational organizations, many of whom have been recognized through recent industry awards ceremonies for their transformational technology projects involving payments automation, cashflow visibility, and global security and compliance control.