Introducing Our 5th Year of Comprehensive Treasury Technology Research

Now in its 5th consecutive year, Strategic Treasurer’s Technology Use Survey, currently underwritten by TIS, has captured data and feedback from over 1,000 treasury and finance practitioners since 2017.

Each year, this panel survey polls a diverse population of treasury and finance leaders regarding their usage of – and experiences with – various treasury technologies, capabilities, and solutions. The research also seeks to capture the industry’s general satisfaction levels with the existing treasury technology they have in place, and also ranks treasury’s priorities regarding what is most important when evaluating and selecting new fintech partners and software solutions.

2023-2024 Treasury Technology Highlights

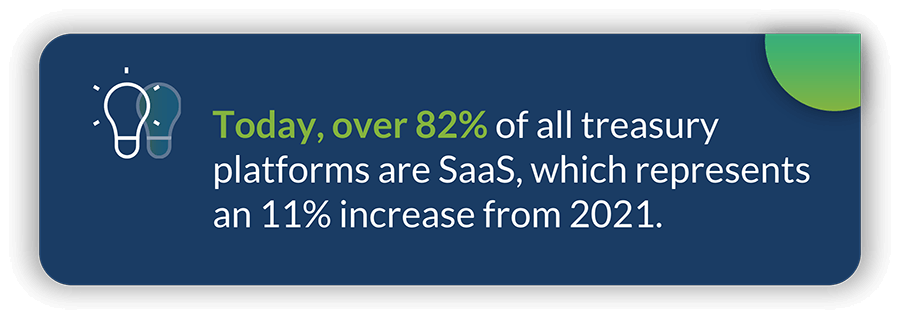

This 2023 survey iteration, which ran from May 1st – July 31st and captured responses from nearly 250 senior treasury professionals, has highlighted several core trends actively shaping the space. Among them include the continued dominance of SaaS and cloud technology as the preferred choice for treasurers when adopting new software solutions. Today, over 82% of all new treasury implementations are of SaaS solutions, which represents an 11% increase from 2021.

Looking beyond SaaS popularity, 2023 data has also shown that corporate interest in artificial intelligence and machine learning (AI and ML) solutions – especially surrounding treasury use cases in cash forecasting and fraud prevention – are at all-time highs. In fact, many organizations are already seeking opportunities to invest in AI and ML software, with 23% of respondents indicating their fintech partners actively provide AI and ML solutions for cash forecasting, and 17% for fraud prevention. Moreover, 1/3rd+ of treasury practitioners believe that AI and ML capabilities are especially important to them when evaluating new technology, so this is an area where we expect rapid growth in the next 1-5 years.

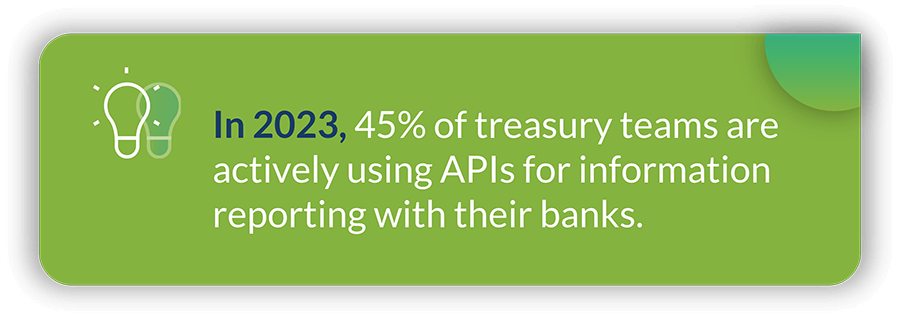

In other areas of tech, 2023 research has shown that corporate adoption of APIs to facilitate payments and reporting functions is continuing at a high pace. In 2023, 45% of treasury teams are actively using APIs for information reporting with their banks, and 28% for executing payments with their banks. Compared with survey results from 2021, this represents double-digit growth in API adoption, as well as triple-digit growth since 2018. And more recently, adoption in the U.S. of the FedNow® service to facilitate real-time domestic payments and interbank clearing is already at ~15%, with another 15% planning to integrate FedNow within the next 12-24 months. This represents very rapid adoption, as FedNow has only been live since July of this year.

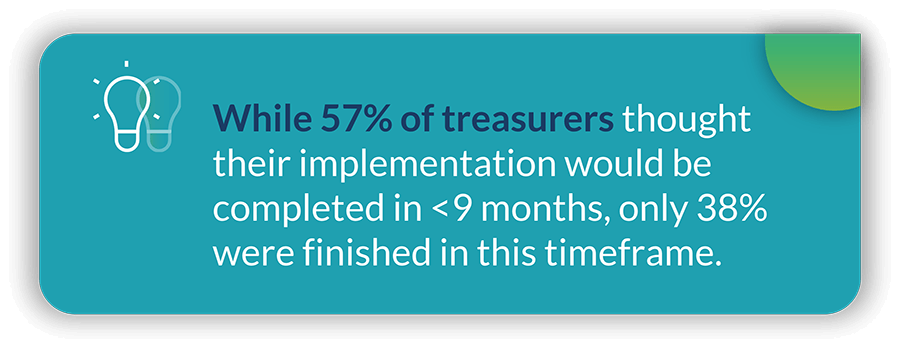

However, despite the high levels of investment and growth we are witnessing across treasury technology, there are still many significant sources of complexity that practitioners must navigate. Today, there remains a substantial gap between most company’s expectations for how long a TMS implementation will take, vs how long such projects take in reality. In fact, while 57% of practitioners expected their implementation would last only 3-9 months, only 38% were completed in this timeframe. Instead, while just 18% expected their implementation to last longer than 1 year, 30%+ ended up taking this long.

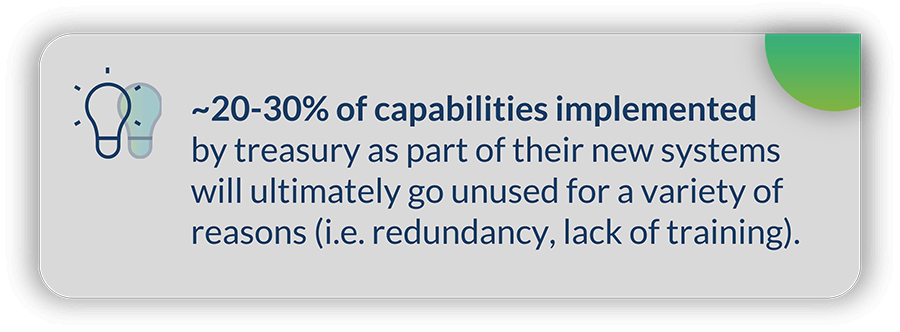

Compounding these implementation issues, data also found that ~20-30% of the capabilities being adopted by treasury are ultimately going unused, either due to technical issues, a lack of education, or redundancies with other solutions. This shows that despite widespread development within the treasury technology ecosystem, there are still a variety of hurdles that professionals must identify and overcome if they are to successfully maximize the automation, efficiency, and control desired from their solutions.

More information about each of these individual key points can be found within the following section, along with a list of recommended “next steps” for companies looking to adopt a new treasury solution in the next few years. Thanks again to all practitioners who participated in this year’s study, and to Strategic Treasurer for managing and conducting the research. We hope you enjoy these findings and find the contents useful. For any questions, don’t hesitate to contact our team directly by visiting our website at tispayments.com, or by emailing info@tispayments.com.

Top Seven Survey Takeaways

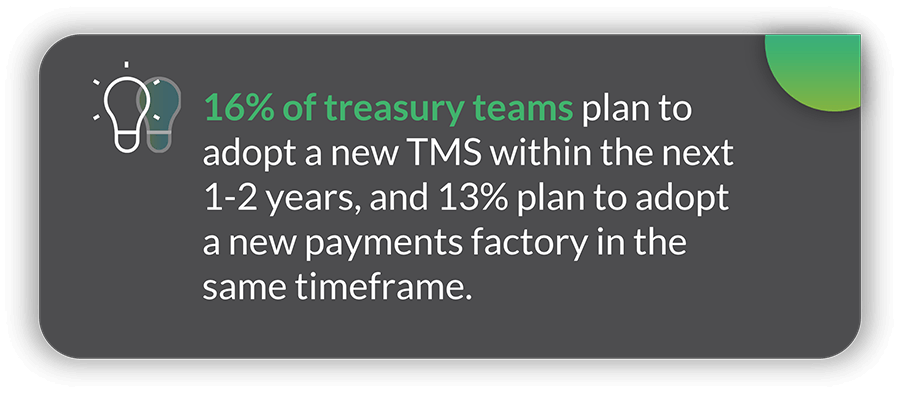

1. Treasury Technology Adoption Remains Elevated: As a whole, treasury technology investment, adoption, and spend has remained elevated in 2023. This includes investments in new ERPs, TMSs, and various e-banking portals, as well as niche fintech solutions for payments, reconciliations, risk management, and more. For instance, 16% of surveyed companies planned to implement a new TMS / TRMS or similar platform within the next 1-2 years, and 13% planned to implement a new payments factory in the same timeframe. 15%+ of professionals also planned to adopt new bank fee analysis and reconciliations platforms by 2025.

In total, there were five individual categories of treasury technology included in the survey that saw more than 10% of respondents planning to invest within the next 1-2 years. This can be perceived as generally good news for the industry, as it’s clear that treasury’s continual adoption of enhanced technology to support their operations remains a top priority.

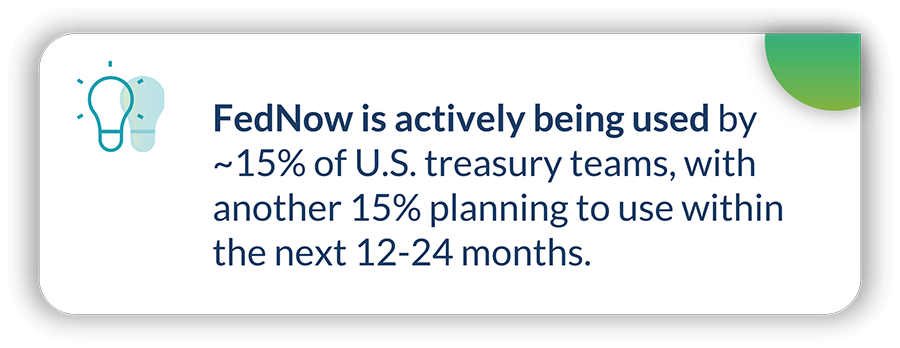

2. FedNow Interest & Adoption is Heavy Despite Having Just Launched: For those who may still be unfamiliar, FedNow is the Federal Reserve’s new instant payment service that enables customers at participating banks and credit unions to send and receive money within seconds, 24/7, for both consumers and businesses. For corporate treasury, FedNow enables payments to be generated and executed on weekends, holidays, and after banks’ business hours, which has not traditionally been possible through standard online transfers such as those through the Automated Clearing House (ACH) network.

The Federal Reserve launched FedNow on July 20, 2023, but more than 120 banks and payment providers have been part of the pilot program since 2021. Today, data from our 2023 research shows FedNow is already actively being used by ~15% of treasury teams, with another 15% planning to integrate FedNow within the next 12-24 months. This shows strong interest in the service within a very short timeframe, with bodes well for the growth of instant and real-time corporate payments across the North American market.

3. APIs Becoming Mainstream for Payments & Reporting: APIs (Application Programming Interfaces) are regarded by many as the future of connectivity within the fields of finance and treasury. Thus, numerous banks and institutions have been focusing on API development for the past decade to improve connectivity and accessibility for their customers, with objectives including seamless data exchange and faster or more automated processing, as well as the capture of real-time balances and execution of real-time payments.

As our research has highlighted, APIs have continued to see steady adoption by corporate treasury, especially to facilitate faster payments and reporting workflows with their banks. In 2023, 45% of practitioners are actively using APIs for information reporting with their banks, and 28% for executing payments with their banks. Compared with survey results from 2018, this represents astronomical growth in the use of APIs for such functions, and we expect this momentum to continue in full force for the next few years. However, it’s worth noting that very few companies are currently relying exclusively on APIs for payments or connectivity, and are instead continuing to use SWIFT, H2H (SFTP), and a diverse number of other channels and options in various areas of their operations.

4. Cloud (SaaS) Solutions Make “On-Premise” a Platform of the Past: Although the original “Treasury Workstation” and early TMSs introduced several decades ago were almost exclusively installed on-premise at a company site, since the early 2000s, adoption of cloud platforms and “Software as a Service” (SaaS) applications within treasury has far surpassed the use of these “local” systems. This is largely due to the greater speeds, reduced onboarding strain, enhanced processing, and cheaper costs associated with using SaaS applications over on-premise platforms.

As of Q3 2023, over 82% of existing treasury solutions are SaaS-based, which represents an 11% increase from 2021. In addition, corporate perspectives on the value that “on-premise” solutions provide has fallen sharply, with 50%+ of respondents listing such solutions as broadly decreasing in value. This is compared with 50%+ of respondents who adversely listed SaaS technology as broadly rising in value. At the current rate, the use of cloud and SaaS applications for treasury technology will be 95%+ globally by 2026-2027.

5. TMS Implementations Frequently Take Longer than Expected: One phenomenon about the treasury technology market is the common misestimation from practitioners regarding how long an implementation project will take. Dating as far back as 2017, Strategic Treasurer research has consistently highlighted that treasury teams will routinely underestimate how quickly they can complete such projects. While many teams believe they can get new TMS platforms up and running in as little as 3-6 months, the reality is that complications with bank connectivity, ERP integration, data formatting, and other functions ultimately create delays.

As survey results have demonstrated this year, 57% of practitioners expected their recent implementation would last only 3-9 months, but just 38% were actually completed in this timeframe. Adversely, 18% expected their implementation to last longer than 1 year, but more than 30% ended up taking this long. In general, this data shows that despite widespread innovation and development within the treasury technology ecosystem, there are still a variety of hurdles that professionals must learn to overcome if they are to successfully maximize the automation, efficiency, and control from their solutions on-time and within budget.

6. Why Do So Many TMS Modules Go Unused? To further exacerbate the issues highlighted above, 2023 research shows that ~20-30% of the capabilities being implemented by treasury as part of their new solutions are ultimately going unused, either due to technical issues, a lack of education, or redundancies with another solution. Shockingly, some tiers of functionality (such as with cash forecasting) are sitting idle for 33%+ of teams, as well as 25%+ for netting, hedging, and exposure management.

Although it’s reasonable to always expect some portion of purchased functionality to go unused, this data demonstrates both a lack of proficiency by companies to properly evaluate and test new software, as well as a lack of service and support on behalf of fintech vendors to effectively train and onboard their clients. Given the high cost associated with treasury software and the amount of time it takes to implement new solutions, any significant lack of usage in this manner represents a massive waste of resources, and this is an area in clear need of improvement from both corporates as well as fintechs moving forward.

7. AI & ML Use Cases Catch on Within Cash Forecasting & Fraud Prevention: For over a decade, there has been broad speculation over what the impact of AI and ML within the treasury environment would be. However, the reality is that it’s taken time for practical development of such solutions to create legitimate industry use cases. And while there’s no denying that the use of AI and ML solutions still remains at an early stage within treasury and finance today, two of the primary use cases that have recently gained momentum revolve around enhanced cash forecasting and real-time fraud prevention.

Today, 23% of treasury practitioners indicated that their fintech partners already offer AI and ML solutions for cash forecasting (up 14% from 2021), and 17% for fraud prevention. In addition, over 1/3rd of treasury practitioners indicated that AI and ML capabilities are particularly important to them when evaluating new technology moving forward, so this is an area where we expect rapid growth in the next 1-5 years.

Next Steps: What Should Treasurers do to Optimize Their Technology Strategy in 2023-2024?

Based on these 2023 results, it’s clear that treasury technology adoption continues to occur at a torrid pace. While new technologies like AI, ML, and APIs are beginning to see mainstream adoption, incumbent technologies like cloud and SaaS applications are also cementing their dominance as the premier choice for hosting new technologies in the corporate space.

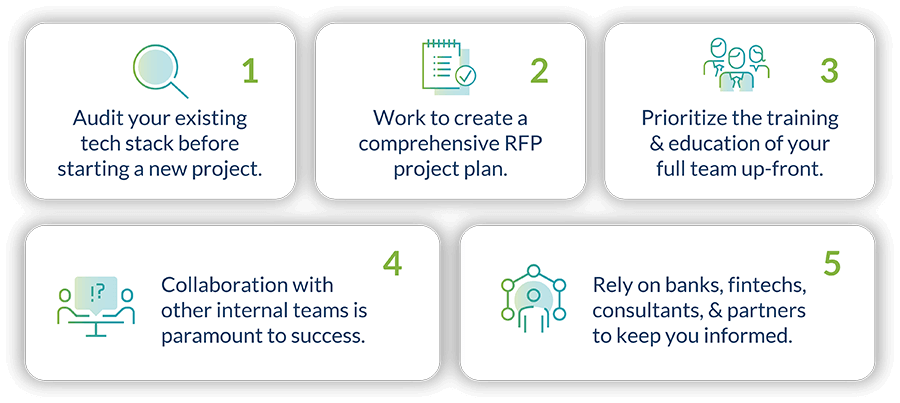

However, despite the general progress in tech adoption and usage, there are still clearly a number of obstacles and pain points being experienced by practitioners that are causing obstructions. In order to help the industry respond to these outstanding issues, the following five points are those we recommend practitioners to consider for their own technology projects and initiatives moving forward.

1. Perform a Complete Audit of Your Existing Technology Before Evaluating a New Vendor: Before pursuing the purchase of a new solution, treasury groups need to develop a complete picture of their existing technology architecture and understand both the current and expected uses for each solution that lies within it. For many teams today, this picture will include the use of one or more ERPs, as well as a TMS, multiple banking portals, and other specialty platforms. In many cases, there will also be redundancies that exist across each of these platforms from a capability, service, and operational standpoint. This means that before another platform is added to the mix, it’s important to understand either how this new solution will simplify the current state and either eliminate the use of existing platforms, or help aggregate, automate, and standardize the data and information stored and processed within them.

2. Create a Comprehensive RFP & Perform Extended Due Diligence on Each Vendor: With a vast and ever-growing Fintech and treasury technology market, it’s easy to grow overwhelmed by the number of options and solutions available. Not only are there dozens of different ERP and TMS providers, but also a huge number of banking platforms and specialized service providers that professionals must consider.

For this reason, it’s critical that each company develop a thorough RFP process that captures responses and feedback from a range of potential vendors and perform ample due diligence on each option. It’s also important to get information from your banks, consultants, and existing vendors during this process to better understand how any new solution will fit into your existing ecosystem. Ultimately, an effective RFP process will help ensure that the best-fit vendor and platform for your specific scenario and use case(s) is identified and selected, instead of simply going with the most “popular” or “preferred” vendor at any point in time.

3. Prioritize Educating & Training Your Employees DURING an Implementation, NOT After: As data from this study has showcased, the ROI and benefits that a new solution provides depend largely on the ability of a company’s workforce to properly deploy and utilize it. For instance, even if a proper RFP is conducted and the right solution is selected, any lack of understanding and education by treasury, banking, or IT personnel regarding the best ways to leverage and integrate the solution can result in substantial impediments to achieving the desired benefits.

To correct this, treasury teams should stress the importance of training to vendors during the RFP process, while also ensuring that internal employees are aware of how the new solution will assist them in performing operations and why it’s necessary for them to be trained and learn the new interface, workflow, etc. Receiving this training DURING an implementation directly by experts from the vendor is also vital to ensure personnel know how to use the solution as soon as it goes live. Over time, it is also recommended to schedule recurring training so that new employees get insight and new solution features can be explained to the team.

4. Collaboration with Internal Departments & External Partners is Paramount to Success: As most practitioners already know, it’s not just “treasury” that is impacted by the adoption of a new treasury technology solution, but also many other internal departments like accounting, AP, AR, Finance, IT, and many of the company’s other banking and fintech partners. There will certainly be a portion of any new tech project that IT will be involved in, and if the project involves an integration with ERPs or other back-office solutions, then it’s likely that other financial departments will have their workflows impacted as well.

Because securing “buy-in” and engagement with these other departments and parties will almost always lead to better performance and utilization of the new solution, it’s highly encouraged that treasury take time to involve these other parties in the project from an early stage, so that they are aware of upcoming changes and have a chance to voice concerns or provide feedback before the new process and technology is implemented.

5. Rely on Your Banks, Consultants, & Industry Partners to Inform You on New Developments: Because of how quickly the treasury technology landscape evolves, it’s easy for practitioners to lose touch with new developments or vendors that are impacting the space. For this reason, it’s vital for professionals to seek guidance from their banking partners, industry associations, and peers for insight on the latest advancements, capabilities, and use cases.

Because many consultants and bankers have visibility to how treasury teams at dozens or hundreds of companies are managing operations, they can often be a good source of information on new innovations or technologies that are proving beneficial at other companies. Elsewhere, practitioners may also get this info by attending regular industry conferences or joining an industry peer group to see what other companies are doing to address today’s most pressing challenges and operational responsibilities.

For more information on best practices for performing a treasury technology RFP, refer to this resource. To learn more about the TIS cloud solution for cashflow, payments, and liquidity, check out our full solutions page or download the “Get to Know TIS” brochure. We hope to hear from you soon!

–