In the modern business environment, cash forecasting is an essential treasury activity. But in order to make the right decisions about the company’s cash, corporate treasurers need both an accurate picture of their current balances, as well as future inflows and outflows. This combination of current balances and future cash flows is critical in order for practitioners to invest cash appropriately, determine how much external debt is needed, manage working capital, and hedge FX flows effectively.

However, during times of uncertainty – whether that’s a recession, a pandemic, or a period of geopolitical instability – the forecasting process becomes even more important. When you’re navigating a volatile environment, it’s particularly important to get decisions right and make sure cash is in the right place at the right time.

The problem?

Creating an accurate forecast is harder when market conditions and customer behavior diverge significantly from historical norms.

In short, this means that cash forecasting is both more critical and more challenging during a recession. So how can you build a robust forecast that gives you access to the information you need, when you need it?

What Does an Industry-Leading Cash Forecast Process Consist of in 2022?

In today’s environment, companies around the world are facing a multitude of challenges, from the threat of recession to record inflation, the Russia-Ukraine conflict, and the worsening energy crisis. The impact of these pressures on consumer demand, as well as on the availability and cost of raw materials, is ramping up the challenge when it comes to predicting future cash flows.

Against this backdrop, it’s paramount that companies embrace best practice in their forecasting processes. First and foremost, that means saying goodbye to spreadsheets if they still form part of your forecasting process. Not only do spreadsheets lack the security controls that a modern treasury needs – they also fall short in numerous other ways, from a lack of scalability to the inability to support scenario and variance analysis.

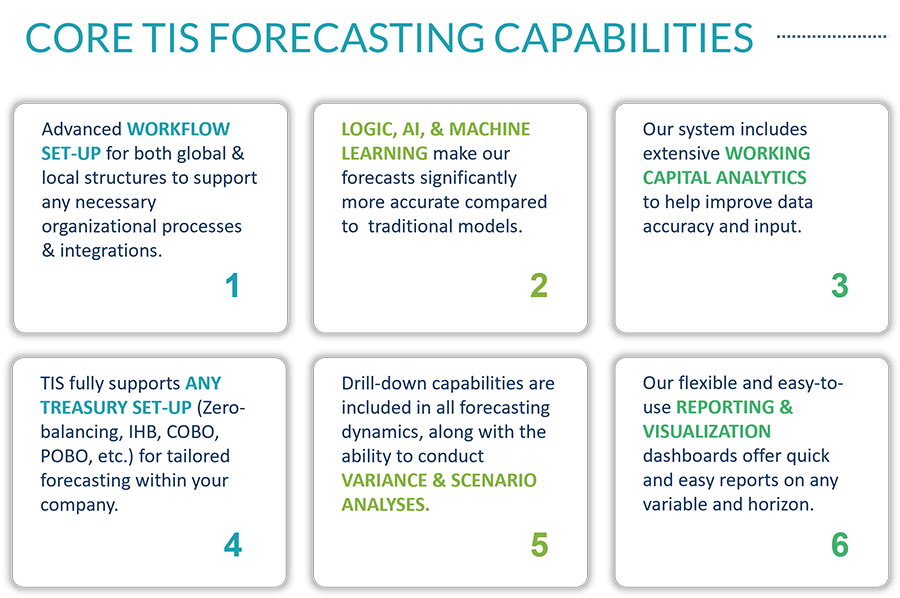

Instead, effective forecasting requires access to a purpose-built tool that provides a sophisticated workflow for your business units and consolidates your source data. Your forecasting solution also needs to support variance analysis: if you can’t measure the accuracy of your forecast against actuals, you have no way of knowing whether the forecast is working for your business, or whether improvements are needed.

Likewise, it’s essential to have a forecast that is flexible enough to adapt to uncertain economic conditions, build different scenarios and simulations, and harness AI and machine learning techniques to improve the accuracy of the forecast. Finally, your forecast can’t be labor-intensive and take weeks to put together, or your data will be old by the time the forecast is available.

Although it can be difficult for treasury groups to find a reliable forecasting tool that provides efficiencies in the above areas, the good news is that TIS can help.

4 Ways TIS Helps You Improve Forecast Automation, Accuracy, & Completeness

Following our acquisition of Cashforce earlier in 2022, TIS now offers robust, AI-powered cash forecasting tools that can consolidate all relevant data sources, automate your data workflows, and support scenario and variance analysis. These have been integrated into our existing SaaS-based payments and liquidity platform, giving you an unparalleled suite of cash, liquidity, and working capital capabilities.

With our new suite of tools, TIS can transform your treasury team from scorekeeper to strategic planner. Proactive cash savings, remarkable time savings, and working capital insights are some of the substantial benefits that can be achieved by working with the TIS Cash Forecasting solution.

In particular, TIS can help revolutionize your company’s cash forecasting in four key areas:

- Comprehensive Bank & Back-Office Connectivity

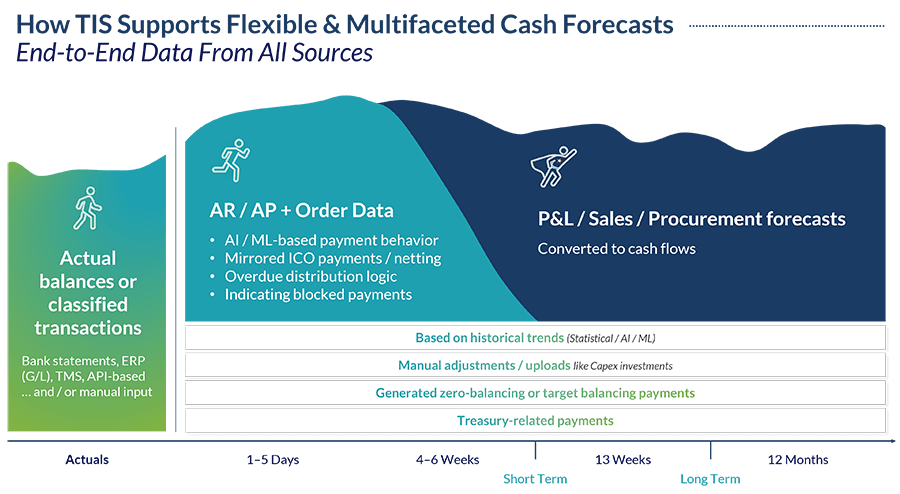

Data is the basis for reliable forecasting. TIS seamlessly combines different sources (bank statements, ERP, TMS, forecasting logics, manual uploads) and includes additional financial data (CRM or order management systems, budgeting systems, sales projections, etc.) to unlock the true value of your data.

As such, you gain crucial improvements to your daily operations, freeing up an enormous amount of time for more strategic work. You can view your current cash position with more knowledge and while keeping track of your financial covenants – which can have a substantial impact on your strategic decisions.

- Workflow-Based Process Optimization

TIS makes it easy to collaborate. By defining clear roles, and a clear set of forecasting process data, TIS enables you to set up a reliable structure for the optimization of your cash forecasting workflows.

Look at your data defined for regions, entities, globally – according to your company’s needs. Slice and dice your data across user-defined dimensions, and retrieve relevant insights on your actual cash flows and cash forecasts.

- Working Capital Insights

TIS takes your payment behavior into account. You can rely on a more accurate forecast based on your usual business activities – and you can also improve your long-term forecasting by supplementing it with AP/AR, procurement, sales, and other relevant data sets.

Understand improvement areas by comparing actuals versus forecast in the TIS elaborate variance analysis environment. Make this variance analysis part of your forecasting process to find inaccuracies and apply improvements to the overall forecasting process.

- Convert Long-Term Forecasts into Cash

The disconnect between Treasury and Financial Planning and Analysis (FP&A) forecast is a common source of reconciliation tension for companies.

Fortunately, TIS enables you to take your long-term forecasting and convert it into cash. Data from the FP&A indirect cash flow forecast can be taken over and combined with your TIS short-term direct forecasts. TIS uses a rules engine that takes ERP data to transform the indirect P&L components into direct cash flow drivers, and calculate timing parameters based on historical trends. Once the purchase order details have been transferred into the system, algorithms calculate cash amounts and timing for both open-ended and closed purchase orders, taking the headache out of what is often a guessing game.

The economic landscape in 2022 is undeniably tough. But in these uncertain times, the TIS Cash Forecasting solution can give you the flexibility, scalability, analysis and insights you need to tailor your forecast to today’s challenges, all while boosting the speed and efficiency of the forecasting process. Get in touch to find out more.

Learn More About TIS’ Cash Forecasting Tools

TIS helps organizations simplify and streamline their global payments and liquidity management operations. Our cloud-based platform empowers businesses to optimize critical functions surrounding cross-border and domestic payments, bank connectivity, cash forecasting, working capital, fraud prevention, sanctions screening, and more.

Corporations, institutions, and business vendors leverage TIS to transform how they connect with global banks and financial systems, collaborate on payment processes, execute outbound payments, analyze cash flow & compliance data, and promote working capital efficiency. Ultimately, the TIS technology platform helps businesses improve operational efficiency, lower risk, manage liquidity, gain strategic advantage – and ultimately achieve enterprise payment optimization.

To learn more about our cash forecasting and working capital analytics solutions, download our latest factsheet or request a solution demo. We hope to hear from you soon!