This article highlights the core complexities that often face treasury teams during ERP migrations. Today, ERP projects usually involve numerous internal stakeholders and thus are rarely spearheaded directly by treasury. However, treasury is often relied upon to help configure the banking and back-office connections that are integrated with the ERP to facilitate payments and financial reporting. And given the broad disparity of connection methods, messaging formats, and payment channels that exist across the global financial landscape, ERP migrations can easily become multi-year projects for treasury that consume considerable amounts of time, energy, and focus. To help navigate this complexity, this article outlines proven strategies that can be employed by treasury to simplify their stake in ERP projects.

ERP Migrations are a Painful but Necessary Component of Treasury’s Responsibilities

To put it bluntly, ERP migrations are often one of the most painful but necessary components of the modern-day treasurer’s tech-related responsibilities.

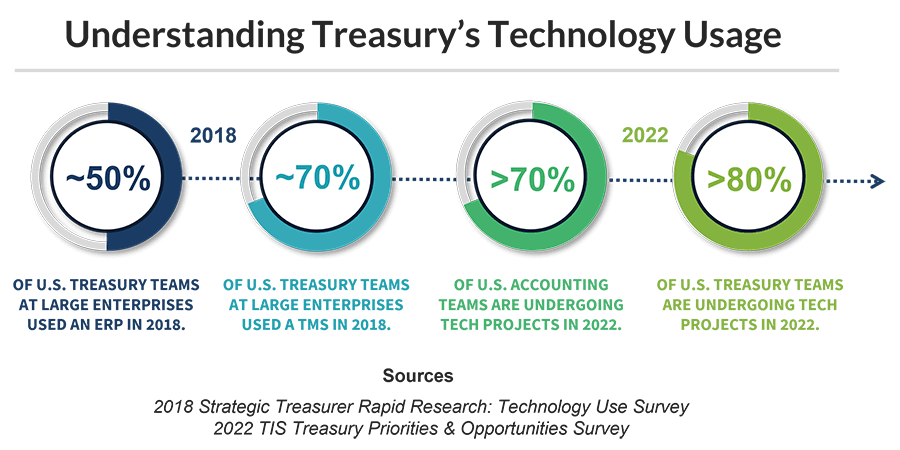

According to a 2018 survey, ~50% of U.S. treasury groups at large, multi-billion dollar organizations were leveraging ERPs to perform at least a portion of their responsibilities. In addition, roughly 70% of these treasury groups were using a TMS, and around 40% were also using specialty payments and banking systems to support their global transaction and liquidity workflows.

Fast-forward to 2022, and data shows that treasury’s reliance on ERP and TMS technology has only continued to increase. In fact, a survey from Q1 shows that over 80% of treasury teams are expecting to undergo a technology-related project over the next 12 months, many of which will involve an ERP migration or implementation.

The problem?

As many treasurers know from experience, ERPs are often large, clunky solutions that require constant upkeep and support. Because few ERPs are built specifically to address treasury’s needs, there are often a variety of customizations or “add-on” capabilities required by treasury to ensure consistent performance and automation. Ultimately, this means that during an ERP migration or implementation, the pathway for treasury to ensure that their existing payments, liquidity, and banking workflows are properly configured with the new system requires significant time and effort.

Today, multinational companies with hundreds of systems, entities, and banks spread across the globe face a myriad of challenges when shifting all these connections from one ERP to another. Given the complexity and constantly changing nature of financial messaging formats, connectivity channels, integration standards, and payment options, each new capability and workflow established between treasury’s core systems and the new ERP must be delicately configured and tested. This requires constant collaboration between treasury and other stakeholders as well as dedicated support from both internal and external IT teams.

Unfortunately, treasury and IT teams that lack the bandwidth or expertise to navigate these complex technical requirements often end up with excessive manual workarounds and inefficiencies related to their new ERP. In many scenarios, these inefficiencies lead to time delays, data entry errors, and compatibility issues across treasury’s financial reporting and payment workflows. In worst-case scenarios, they can also open the door to heightened security, fraud, and compliance risks that cost the company both financially and reputationally.

Let’s explore further.

What Specific ERP Migration Responsibilities is Treasury Often Tasked With?

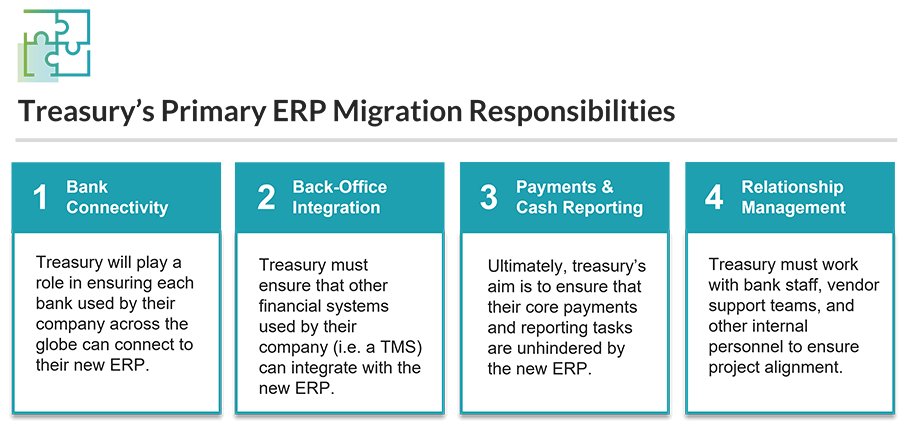

When it comes to treasury’s stake in an ERP migration, there are four primary responsibilities that are most commonly prioritized. They are as follows:

Bank Connectivity: As the steward of payments and liquidity, treasury is often tasked with controlling their company’s global bank relationships and underlying account structure. As a result, treasury is also commonly responsible for ensuring that the connections established between various bank portals / systems and their company’s ERP(s) and TMS(s) are functioning appropriately. This includes confirming compatibility with all required messaging formats and connectivity standards, which for global companies can consist of a myriad of different options.

Back-Office Integration: As payments and financial data flow in and out of a company, the majority of associated workflows are managed by treasury using a dedicated TMS, ERP module, or similar system. As companies shift to a new ERP, treasury will thus be relied upon to ensure the data and information captured in their primary system (i.e. a TMS) can be transmitted to the new ERP in a quick, concise, and effective fashion. For global companies, this responsibility may involve connecting numerous back-office systems spread across the globe to the new ERP.

Payments & Reporting Standardization: In tandem with their system-level responsibilities, treasury will ultimately be relied upon to ensure that the adoption of a new ERP system does not impede the company’s ability to maintain visibility and control over banking, liquidity, and payment processes. Other key functions like forecasting, security, compliance, and risk management must also be managed and optimized through the new configuration as well.

Project & Relationship Management: As treasury seeks to fulfill the above responsibilities, they will be expected to work closely with other internal stakeholders like accounting and IT, as well as external banking personnel and vendor support teams to ensure cohesiveness and alignment across all parties. In many cases, treasury winds up playing a significant role in fostering communication between bank personnel, vendor support teams, and internal IT staff to ensure all the necessary connections, integrations, and workflows are functioning seamlessly from end-to-end.

What Specific Challenges Make Treasury’s ERP Migration Responsibilities so Complicated?

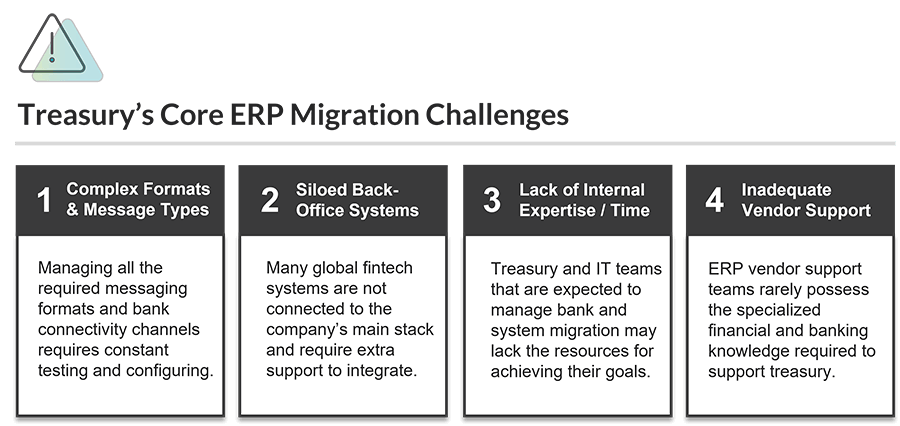

As treasury seeks to perform their aforementioned responsibilities, there are several core challenges that often cause the majority of headache for practitioners. These challenges are as follows:

Disparate Financial Messaging & Bank Connectivity Requirements. For multinational companies with banks and accounts in numerous regions, the underlying messaging formats and transmission channels that are relied upon to transmit funds and data can vary broadly. Essential messaging formats can include both SWIFT MT and ISO 20022, as well as a variety of local flavors like EDI, BAI2, and so on. The same is true with regards to connectivity, as large corporates commonly use a variety of host-to-host (H2H) channels as well as SWIFT and other regional connections like EBICS. Due to the disparity of these channels and formats and their underlying technical configurations, establishing compatibility between them and a new ERP is a complex and time-consuming task that requires constant testing and refinement.

Siloed or Piecemeal Back-Office Fintech Environment. Large enterprises with subsidiaries and offices spread across the globe can easily let their technology stack get out of hand as personnel at each location gradually adopt their own unique solutions and workflows. In the end, this lack of standardization can result in dozens of different back-office systems and workflows being incorporated to an enterprise’s global structure, which almost always leads to process redundancies, manual workarounds, and siloed data. During ERP projects, the task of integrating each of these disparate back-office systems with the new ERP to ensure streamlined financial reporting and payment processing can take months or even years to complete.

Lack of Expertise & Bandwidth Across Internal Teams. For internal treasury and IT teams that are expected to play a large role in an ERP migration, sometimes the biggest challenge faced is simply a lack of expertise and bandwidth. Given that treasury groups commonly consist of just a few individuals that are already exasperated with their daily workload (77% of U.S. treasury groups saw their task list increase in 2022), the addition of a time-consuming and complex ERP project can throw the entire department into turmoil as individual team members struggle to perform all their required duties. The same goes for IT teams that are being relied upon to configure connections and integrations, but that may be working on numerous projects internally and cannot dedicate the appropriate amount of time to treasury’s specific needs.

Limited Availability of Vendor & External Support Teams: In relation to the above point, the unfortunate reality today is that many ERP support teams are inadequately equipped to help treasury with configuring bank connections and back-office integrations. Usually, ERP vendor personnel are focused exclusively on ensuring that the core capabilities of the new system are functioning, thus leaving the specialized connectivity and integration components of the implementation to other stakeholders. As a result, treasury can rarely depend upon an ERP’s support staff to establish all required bank and back-office integrations for them and must instead turn to other sources and avenues for accomplishing this.

How Can Treasury Simplify & Streamline Their Role in ERP & New System Migrations?

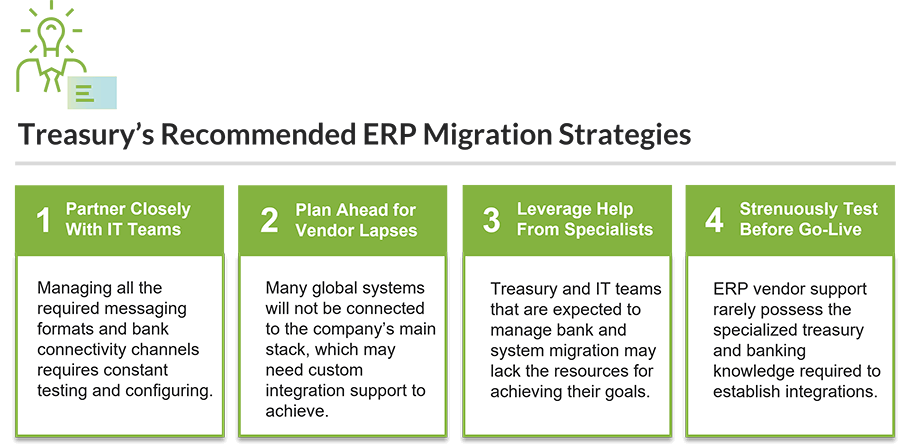

To mitigate the impacts of the above challenges on treasury during an ERP migration, the following steps should be strongly considered by practitioners at the onset of their projects to ensure a smooth and seamless transition.

Partner Closely with IT to Ensure Project Prioritization & Alignment. Over the full course of an ERP migration, treasury will almost always have to collaborate with their internal IT teams to ensure the proper configuration between their banks, back-office systems, and the new ERP. As such, treasury should approach IT well in advance of the project’s start and begin outlining all required technical aspects of each required integration and workflow in order to provide visibility over their current structure and reporting requirements. This will ultimately help IT understand exactly what needs to be accomplished by treasury for the project to be successful.

Plan Ahead for Shortcomings from ERP Support Teams. In most circumstances, treasury will not be able to rely exclusively on ERP support teams to provide the high-touch service necessary for integrating their existing systems and banks. Although exceptions do exist, treasury should not plan on having these external teams manage the bulk of heavy lifting for them and should be proactive in identifying other internal or external resources that can be leveraged for support. This is especially crucial if internal treasury and IT staff clearly lack the bandwidth to manage their respective requirements for implementing and testing the new ERP, as this means that an external consulting or IT group might need to be contracted.

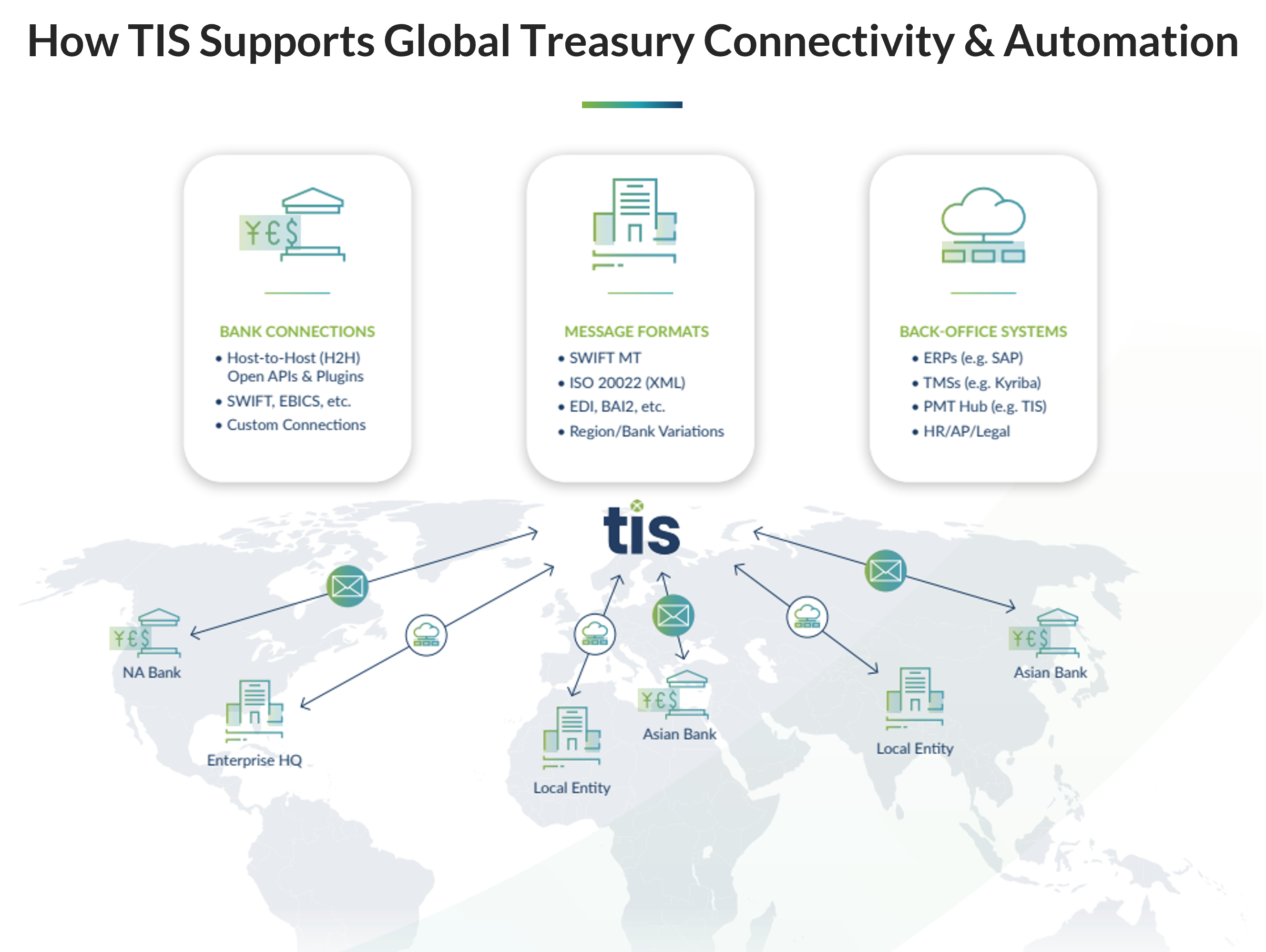

Use Specialist Vendors to Establish ERP Connectivity & Automation. In order to streamline the task of connecting all of a company’s banks, systems, and workflows to an ERP without requiring extensive support from the vendor or internal IT staff, it is strongly recommended that treasury teams consider how specialized solutions like TIS can aid in the process. As it stands, vendors like TIS have already developed the treasury-specific API integrations and bank connections required by multinational companies, including support for all required formats (ISO 20022, MT, EDI, BAI, etc.) as well as all required connectivity options (H2H, SWIFT, API, EBICS, etc.). Subsequently, rather than having to individually configure and maintain each connection with the ERP, treasury can simply let TIS’ support teams manage all underlying connectivity between the ERP and their global banks and back-office systems. In this way, treasury need only concern themselves with 1-2 core connections, rather than having to individually manage each integration and workflow on its own.

Test Workflows with Other Departments Scrupulously Before Go-Live. For businesses with a variety of complex integration and workflows, testing each configuration that is established with the new ERP is critical before the “go-live” stage. After go-live, any unforeseen errors with data transmission, such as the incompatibility of certain formats or integration options, can cause significant delays and gaps and will almost always lead to treasury instituting manual workarounds. And because IT and external support teams will likely be less available to help fix these errors after the “go-live” and subsequent culmination of the project, ensuring that every touchpoint treasury maintains with the new ERP is functioning properly is essential. This step will likely require treasury’s collaboration with other departments like accounting and the c-suite as well as external banking and vendor teams to ensure that financial reports and data are being transmitted and received properly.

How Does TIS Help Companies Manage Back-Office & Banking Connectivity?

For businesses that read this article and recognize a need for added support as part of their own ERP or TMS implementation, we would strongly urge you to consider the solutions and services provided by TIS.

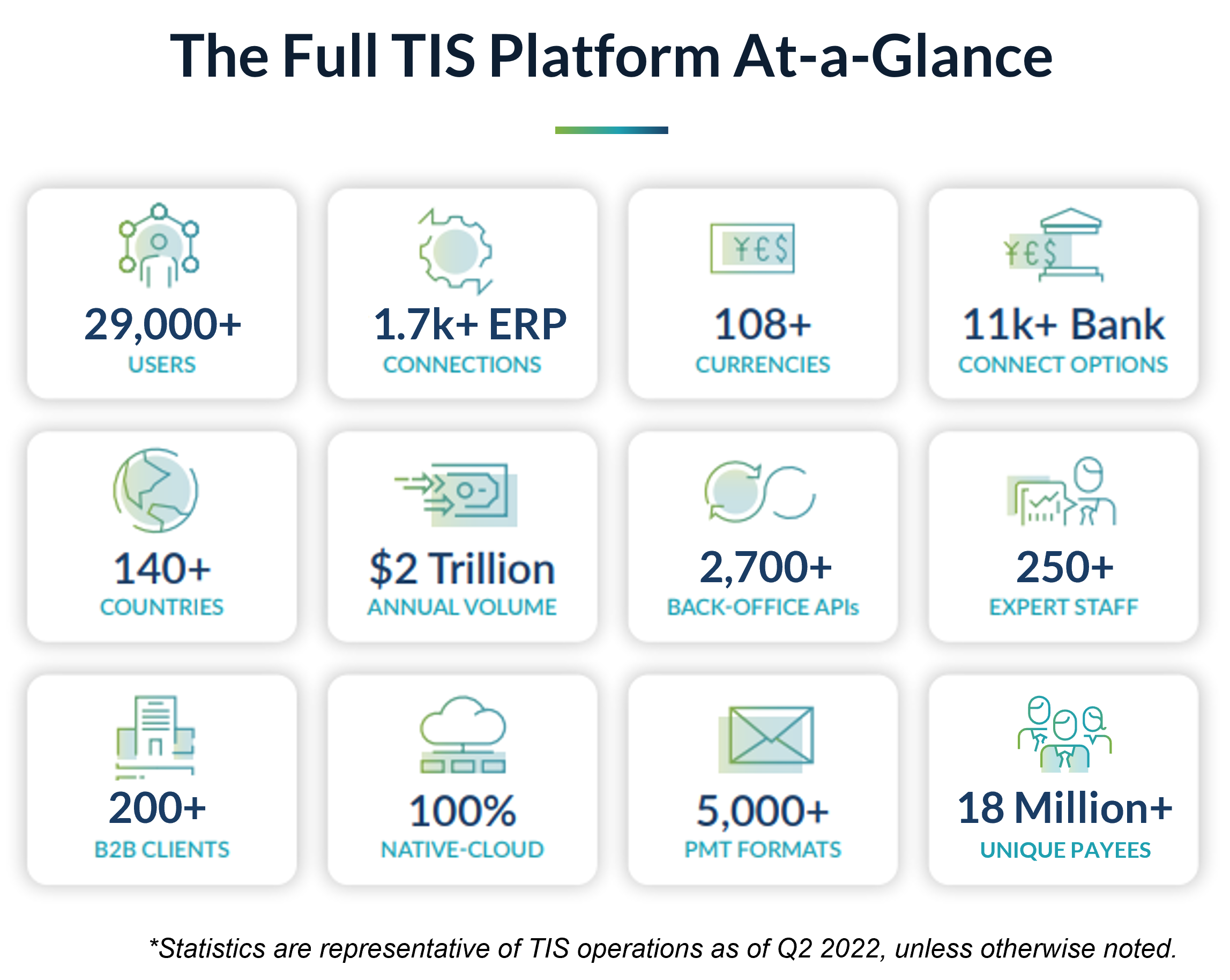

Today, TIS helps streamline treasury automation through a cloud-based platform that is uniquely designed to help global organizations optimize payments, banking, and liquidity. In essence, the TIS solution is a multi-channel and multi-bank connectivity ecosystem that simplifies the processing of a company’s payments across all their global entities and systems. By sitting above an enterprise’s technology stack and connecting with all their back-office, banking, and 3rd party solutions, TIS effectively breaks down department and geographic silos to allow 360-degree visibility and control.

To date, the more than 200 organizations that have integrated TIS with their global ERPs, TMSs, and banking landscape have achieved near-real-time transparency into their payments and liquidity. This has benefited a broad variety of internal stakeholders and has also enabled them to access information through their platform of choice.

As part of our service structure, TIS’ specialized support teams work to integrate all required back-office and banking connections that an enterprise maintains in order to facilitate straight-through-processing. This includes compatibility with all known financial messaging formats, bank connect options, and integration standards. This systematically controlled integration workflow is managed by TIS across the entire scope of an organization’s banking and back-office landscape, and data can be delivered from any system or bank via APIs, direct plug-ins, or agents.

As a result of the above services and solutions, TIS is able to provide the real-time data, control, and workflows needed for treasury to simplify their role in any ERP project.

For more information about the value that TIS provides, visit our website or request a demo with one of our experts.