[vc_row][vc_column][vc_column_text]This article provides a thorough review of bank account management (BAM) operations as they are performed by treasury practitioners within the modern business environment. We will also explore the leading practices, solutions, and technologies used by most companies for managing BAM / eBAM functions today.

For more information about TIS’ suite of bank account management capabilities, refer to our official solution page or download the associated factsheet.

What is Bank Account Management & Why is it Important?

Within the context of corporate treasury, bank account management (often referred to as “BAM” or “eBAM” for electronic BAM) is one of the most fundamental responsibilities of modern practitioners. Traditionally, bank account management refers to the strategic and operational processes involved in effectively overseeing and controlling a company’s bank accounts, including all functions related to opening, maintaining, and optimizing bank accounts to achieve financial efficiency, security, and compliance. It also covers the process of systematically managing the transactions and cash balances that flow through these accounts, as well as any data related to bank addresses, IBAN and routing numbers, the “signers” with approval rights over each account, and so on.

Today, a significant portion of these tasks can be performed using a variety of software tools, ranging from Excel and e-banking portals to ERPs, TMSs, and other Fintech solutions. We will explore the use of these solutions more in a later section.

As it stands in 2023-2024, treasury professionals that oversee their company’s bank account management functions are typically responsible for the following operations:

–

–

Core Bank Account Management Tasks

1. Developing an Account Structure: A critical priority for treasury when it comes to BAM is determining the appropriate number and types of accounts needed for different financial functions, such as operational accounts, payroll accounts, tax accounts, and interest-bearing accounts. Perfecting this structure may also require treasury to introduce in-house banks or cash pooling and sweeping structures.

2. Tracking Open & Closed Accounts: Managing open and closed bank accounts across the company globally (across all banks, countries, and entities) is considered a standard bank account responsibility for treasury. In today’s fraud-laden environment, maintaining near-real-time visibility over account opening and closing activity is critical in order for treasury to maintain compliant, risk-free, and transparent bank account operations.

3. Managing Approved Signer Lists: Tracking the approved “signers” with authority over each of the company’s bank accounts across each bank, country, entity, etc. is another standard component of BAM. This is another role that is vital for reducing the threat of fraud, especially as it relates to having duplicate signers on accounts (or forgetting to remove signers after they leave the company). Managing a clean signer list is also important for keeping up with various banking regulations that impact corporates, such as with FBAR in the US.

4. Maintaining Updated & Accurate Account Data: As a part of BAM, treasury will be expected to maintain organized and accurate data related to bank addresses, financial statements, account numbers, relationship managers, and routing information. This includes responsibility for updating these records over time as employee turnover, company growth, and bank relationships dictate.

Correlated Bank Account Management Tasks

5. Bank Relationship Management: One of treasury’s main responsibilities relative to BAM involves establishing and maintaining relationships with each of their company’s banking partners, negotiating the related terms and fees, and evaluating the quality of services provided.

6. Reporting on Bank Account Transactions & Cashflows: As a function closely tied to their oversight of company bank accounts, treasury will be relied upon to monitor and report on the various payments, cash balances, fees, and general activity that occurs within each account over time. This includes the process of cash positioning and workflows for bank statement management.

7. Performing Bank Fee Analysis & Account Reconciliation: While it can be tedious to undertake, the process of analyzing bank fees and service charges to identify opportunities for cost-savings can become a significant portion of treasury’s BAM responsibilities. Such projects are often necessary for ensuring the company’s account structure is as streamlined and optimized as possible. In addition, reconciling bank account statements with internal records to identify discrepancies, ensure accurate accounting, and detect potential fraud is an area BAM that treasury will certainly have a stake in – typically in alignment with accounting.

Why are Bank Account Management Roles Usually Entrusted to Treasury Teams?

Over the past decade, industry data from the consulting firm Strategic Treasurer has consistently shown that the vast majority of treasury teams hold primary responsibility over bank account management operations at their respective companies. This is, of course, with the help of HR, legal, and other finance groups to perform various related tasks surrounding account compliance, reconciliations, and reporting.

In large part, corporate treasurers are the ideal department to manage the company’s banking operations due to their unique blend of financial visibility, operational control, and risk management oversight. As the natural stewards of payments and liquidity and with a deep understanding of company cash flows, treasury professionals are perfectly positioned to analyze and allocate funds across various banks, manage the associated account structures and bank relationships, and monitor account activity to identify fraud, maintain compliance, and report on balances and transactions.

Because most treasury teams are already working to foster strong banking relationships, negotiate favorable service terms, and stay abreast of regulatory changes that impact banking activities, their holistic perspective on the organization’s financial landscape enables them to naturally align bank account management with their other existing responsibilities.

What Technologies are Typically Used by Treasury to Manage BAM & eBAM?

For modern treasury teams, there are five main types of software solutions used to assist with bank account management. Depending on the stage of a company’s maturity, size of their global footprint, and complexity of their banking operations, a diverse mix of these different solution types may exist within any specific organization. Usually, it is Excel and banking portals that are used most prominently by small and mid-market companies, while larger and more complex companies use these tools in conjunction with more sophisticated ERPs, TMSs, or specialized BAM solutions.

Let’s quickly review each of these five standard BAM software tools in more detail:

1. Microsoft Excel: Microsoft Excel has held a prominent position in the corporate finance realm since it was first introduced in the 1980s and remains the go-to tool for many treasury teams when it comes to tracking and managing bank account data. Despite a myriad of solutions developed over the years to replace spreadsheets, the simple truth is that Excel is often the easiest tool available to track and manage bank account information – especially in the early days of company growth – due to its low cost and intuitive functionality. However, as a company expands, a more complex and larger number of spreadsheets must be created and managed until a time comes when companies have no choice but to replace their tangled mess of spreadsheets with more specialized software. Due to this natural progression, it’s common for most companies to start off using Excel and then always continue using it to some extent, even if the goal is to gradually reduce or eliminate reliance on spreadsheets over time.

2. E-Banking Portals: To manage payments execution and core cash positioning, most treasury teams at small or mid-market companies will rely on an array of individual banking portals that are provided directly by their banking partners. These online portals can be used to initiate transactions, check balances, and perform a variety of other standard bank account management tasks, in a manner similar to how a consumer or individual uses their own online banking app to manage these tasks. But while these portals are usually effective in the early stages of company growth, widespread expansion usually results in a scenario where companies must juggle dozens of individual bank portals to manage operations, which is an inefficient and error-prone process to maintain over time.

3. Enterprise Resource Planning (ERP) Software: ERPs (like SAP®, Oracle, Peoplesoft, etc.) are some of the most common types of systems in use by corporate finance departments – including accounting as well as AP, AR, and even treasury. Modern ERPs are usually provided as cloud-based systems that help perform a variety of core financial tasks, including reporting, reconciliations, invoicing, payments, cash management, and many more. Although some of the functions that treasury oversees can be too complex or specialized for an ERP to cover (such as enhanced hedging, risk management, cash forecasting, bank connectivity, etc.), at larger companies, ERPs are almost always a component of the company’s back-office technology structure. And at global companies, multiple ERPs may even exist across different regions, entities, or business units. As it relates to bank account management, certain ERPs have functionality that can be used to connect to a company’s banks so that data can flow directly into these systems for reporting and upkeep. Some ERPs may also have dedicated BAM functions or modules as well, but these are typically not as robust as what is provided through a TMS or specialized eBAM solution, as highlighted below.

4. Treasury Management System (TMS): Treasury Management Systems are specialized software packages, again usually cloud-based, that provide treasury teams with a variety of capabilities for managing payments, cash flows, working capital, security, compliance, debt and investments, and many more functions (including bank account management). Although TMSs may be too sophisticated and expensive for smaller or even some mid-market companies, they usually become essential components of corporate finance’s technology structure as a company grows. Today, many available TMSs on the market offer a degree of bank account management functionality, as well as broader bank connectivity and financial messaging services.

5. Specialized BAM Software: In cases where companies are managing a vast and complex number of banks, accounts, and associated cash flows and transactions, specialized bank account management (BAM) software may be warranted to provide enhanced functionality for opening and closing accounts, managing signers, creating custom pooling or sweeping structures, and more. As touched on above, although many modern TMS solutions may double as eBAM or banking solutions, there are cases where a specialized BAM solution may be used by treasury in conjunction with a TMS or ERP. It ultimately depends on the complexity of an enterprise’s banking relationships and the adequacy of their existing technology stack.

5 Leading Practices for Treasury to Handle BAM Functions in 2023-2024

As we close out 2023 and head into 2024, there are a variety of strategies that treasurers can deploy to increase the efficiency and effectiveness of their bank account management workflows. Based on recent data from the Association for Financial Professionals (AFP), consulting firm Strategic Treasurer, and other industry groups, the following five tips are highly recommended for practitioners to consider as they prioritize improvements to their eBAM functions over the coming years.

1. Creating the Right Bank Account Structure is Paramount to Gaining Efficiency: Although no two company account structures may be the same, what’s important is that treasury conduct a thorough audit of their banking operations and seek to determine where new workflows can be introduced. For instance, treasury may decide that implementing various cash concentration techniques to centralize funds from subsidiary accounts into a primary operating will enhance cash visibility, reduce idle cash, and supports better liquidity management. Tailoring the company’s mix of virtual accounts and operating accounts to save fees and streamline cash collection can be another source of optimization. And finally, identifying areas where an in-house bank or other cash pooling and sweeping structures could be introduced can ultimately create hundreds of thousands (if not millions) of dollars in annual savings.

2. Bank Fee Analysis & Account Rationalization Projects are Inconvenient but Necessary: Although bank fee analysis and account rationalization projects can require significant time and bandwidth to perform, the results can provide significant cost-savings, process automation, and simplification of account structures and bank relationships. For large, global companies, it’s not uncommon for these types of projects to end up saving hundreds of thousands of dollars in maintenance, service, and account fees, as well as other various technology and transaction costs. They are also important for ensuring your bank partners are providing the most cost-effective services to your team. As a result of these projects, treasury may realize that they can save time and money by eliminating certain accounts or relationships that are inefficient or expensive to maintain, and can streamline their operational processes in a similar fashion.

3. Strategic Technology Deployment is Critical: Although there are situations where Excel and bank portals may still provide treasury with ample coverage for bank account management, advanced TMSs and cloud platforms that offer real-time visibility into bank balances, transaction activity, and cash flow forecasts will usually become necessary sooner or later. When adopted strategically, these solutions can automate and streamline many of the mundane and cumbersome workflows related to BAM. In large part, the ability for these solutions to serve as a central point of connectivity for all of a company’s banks and accounts so that cash positions, account balances, and payments activity can all be managed and monitored through a single system (rather than through numerous spreadsheets and bank portals) can create huge efficiency gains for teams – especially those working with dozens of banks and hundreds or thousands of accounts.

4. Bank Account Information is a Regular Target for Fraud: Given the increasing sophistication of cyber threats, an updated bank account management structures can go a long way in protecting sensitive financial data and transactions. Today, it’s imperative that companies maintain real-time visibility on the opening and closing of accounts, and that signer records are always updated immediately as employee turnover dictates. At the same time, it’s highly recommended that treasury conduct regular audits of their bank account records or adopt software that can monitor their account data and generate alerts any time data is changed, or whenever certain bank account details appears suspicious. Finally, treasury should implement techniques like multi-factor authentication, segregation of duties, and routine staff education policies to ensure a multifaceted approach to mitigating the risk of fraud.

5. Bank Account Compliance Varies Broadly by Region & is Constantly Evolving: Over the past few decades, regulatory oversight and governance within the corporate banking sector has ballooned. Today, treasury teams are required to comply with a broad variety of complex and evolving mandates – such as FBAR in the US – and are also impacted by bank-specific regulations such as Basel III / IV, Dodd-Frank, Know Your Client (KYC) protocols, and many more. To make matters more confusing, these regulations can vary broadly by country and region, with specific guidelines in place for controlling the bank operations and accounts in each area. And given the heavy penalties and legal ramifications associated with non-compliance, it’s imperative that treasury take the time to review and assess operations in each country or area of jurisdiction to ensure alignment with relevant regulations in each circumstance. Failing to do so opens the company up to significant reputational, legal, and financial harm.

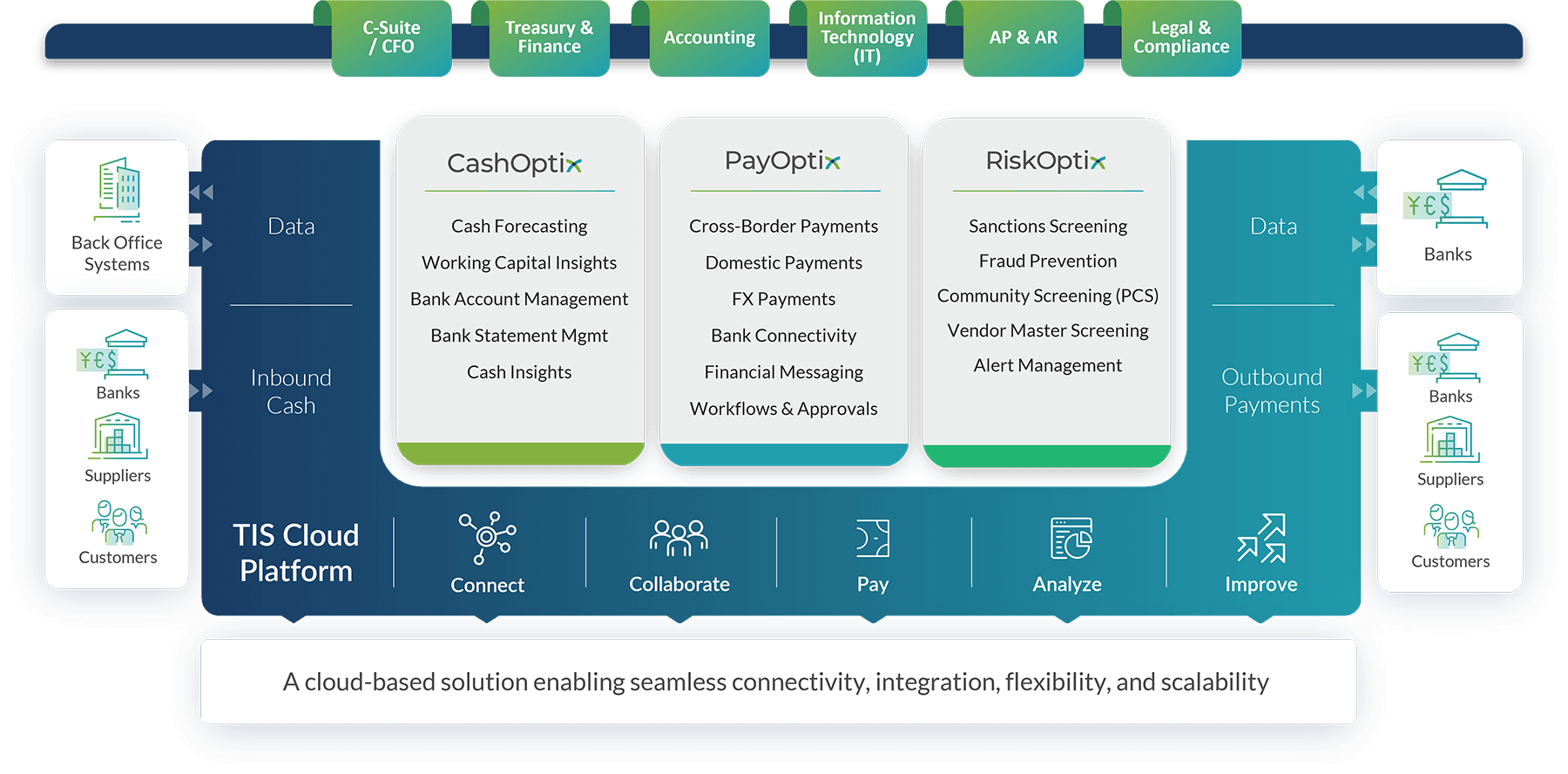

How TIS Enables Streamlined & Efficient Management of Bank Accounts for Treasury

For organizations that today find themselves in need of an improved process for managing their bank relationships and associated account data, we would strongly encourage you to evaluate the services provided by TIS.

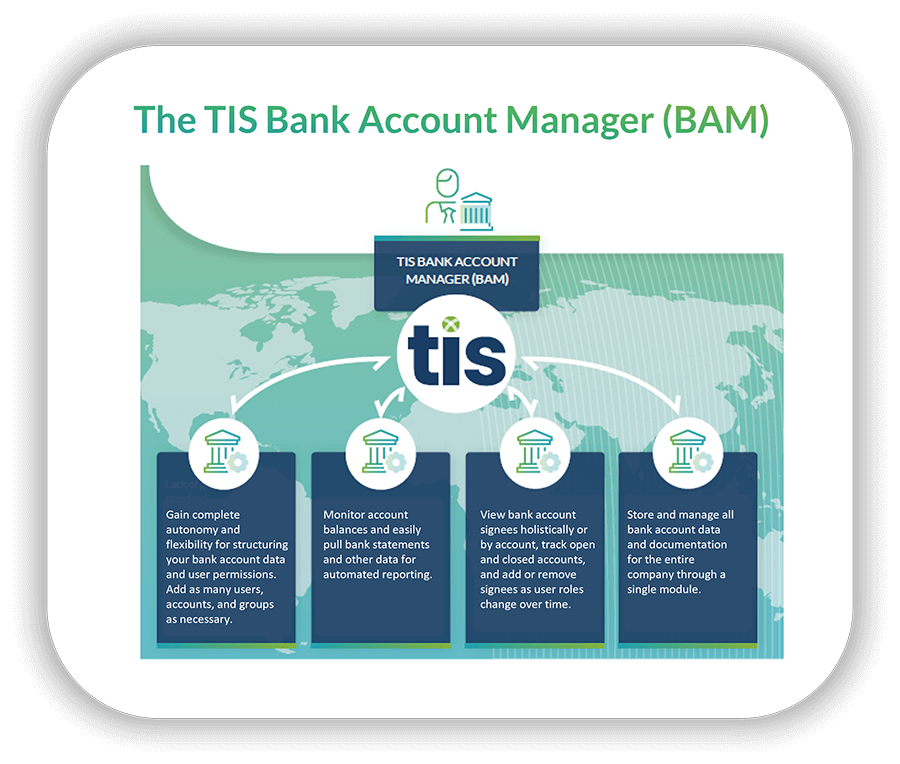

Today, TIS’ Bank Account Manager (BAM) solution serves as the single source of truth for clients as they manage their global banking, payments, and data workflows. Organizations can effectively use TIS as a central repository for all of their bank account information and related master data across all connected systems, including ERPs and TMSs. As an essential component of our cloud (SaaS) platform, TIS’ BAM capabilities enable clients to easily perform core functions such as tracking open and closed accounts, assigning and managing account signers, and storing unique banking information.

In addition, TIS also offers customization to define fields and workflows. Data inventory processes, for example, can be started anytime the customer requests and on a regular basis to ensure responsible users can keep all the data up to date. The inventory processes can be set on company, region, or legal entity level. And for reporting, the data in BAM can be automatically leveraged for other functions in TIS, such as reporting on the associated account balances for expedited analysis.

“Jacobs Douwe Egberts is operating with more than 30 banks globally. We needed a partner that was well established and has a lot of experience with our main banks. And that’s why we decided to choose TIS.”

– Bob de Graaf, Global Treasury Operations Manager at Jacobs Douwe Egberts

One of the primary benefits of TIS’ BAM is the flexibility offered to users in how they structure their workflows for bank account management and master data maintenance while also staying compliant with global and local regulations. For example, an “n-eyes” principle can be configured for making changes to master data at a global, regional, or entity-level, as well as for creating, updating, closing, and deleting bank accounts.

Data from the connected banks and bank accounts in BAM can be viewed via a single interface in the Bank Statement Manager. The dashboard is customizable and provides users with full visibility to bank account data and balances on a global scale, as well as granular analyses for reviewing the data behind any specific account, currency, country, or business unit. Clients can also create custom bank groups to view their account structure by region, currency, or otherwise, and can assign multiple signees over each account or account group as internal protocols dictate. The result of these interfaces is that global account data, cash positions, and cash flows can be viewed faster and more reliably with just a few clicks of a button. This provides tremendous upside compared to excel-based BAM solutions or the use of numerous e-banking portals, especially from an automation and accuracy standpoint.

As system users go about managing their bank account data in TIS, they can create custom reports to quickly view items like signee designations, user roles, and account balances. Unlike static reports, the interfaces and dashboards provided by TIS are “live” and offer a great deal of interactivity. In addition, BAM offers different options for the import and export of master data and the export of audit logs. These features facilitate the exchange of information across departments and ultimately make bank account compliance reports (such as for FBAR in the U.S.) much easier. They also offer significant time-savings and improved data accuracy over other traditional BAM methods.

Key BAM Functionalities Offered by TIS

- Manage global bank account data and documentation in a single source of truth

- Manage, add, and remove signers over bank accounts

- Track open and closed accounts

- Maintain a global overview of bank account data

- Conduct flexible inventory processes to identify outdated information

- Facilitate easier bank account reporting workflows (i.e. for FBAR in U.S.)

For more information about our suite of bank account management capabilities, refer to our official BAM solutions page or download the full factsheet.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_empty_space height=”128px”][/vc_column][/vc_row]