Congratulations to TeamViewer for winning the 2023 Alexander Hamilton Small Company Excellence Award in the category Technology Excellence! This article was originally produced and featured by Treasury & Risk’s Editor in Chief Meg Waters. You can view the original post here.

About TeamViewer & Their Award-Winning Treasury Technology Project

TeamViewer is a global technology company that provides a connectivity platform for remotely accessing, controlling, managing, monitoring, and repairing devices of any kind—from laptops and mobile phones to industrial machines and robots. The solution enables companies of all sizes, and from all industries, to digitalize business-critical processes. Since TeamViewer’s founding in 2005, the organization has grown rapidly. To date, its software has been installed on more than 2.5 billion devices around the world.

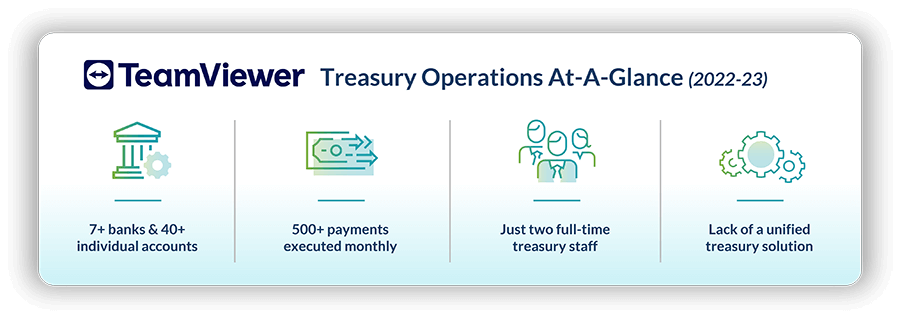

By the beginning of 2019, TeamViewer consisted of 10 legal entities, which had 39 bank accounts in seven different banks across 11 countries. The two-person treasury team struggled to keep up with day-to-day tasks.

“We had a lot of manual work to do,” explains Sabine Kießling, director of controlling and treasury for TeamViewer. “For German banks, we were able to connect our centralized financial system to the banks using EBICS [the Electronic Banking Internet Communication Standard]. But for our accounts in banks outside of Germany, we had to get information from the bank’s back end via a web browser. Our senior treasury manager, Peter Mahringer, had to carry around, at all times, close to 20 different physical tokens.”

For 24 of the company’s bank accounts, Mahringer would log into an online portal multiple times each day, then copy and paste data into a cash positioning spreadsheet. The inefficient process not only consumed too much of his time, but also created barriers to visibility into core treasury information. “It was very time-consuming to log into all the different systems,” Mahringer says. “If our CFO asked for our cash position at the moment, it would take us three or four days to get an answer. And by that time, the answer we had was already out of date.”

Consolidating bank accounts was not the answer. “We have a lot of smaller customers that are not used to international payments,” Kießling explains. “It helps them if we have a local account in their country—and it helps us too, as it makes the transaction easier. So we try to have at least one bank account in each of the larger markets that we serve.” At the time, TeamViewer was also undergoing frequent mergers and acquisitions (M&A), and every new entity that the company added to its portfolio “brought its own banks,” she adds. “We were experiencing incredible growth, and it was quite clear our manual approach was not scalable or sustainable.”

One additional concern for TeamViewer’s treasury team was the security risk created by continuously logging onto and off of bank portals. “We were approaching an IPO [initial public offering], and we knew that as a publicly listed company, we could not risk a security issue,” Kießling says. “We did not have great visibility into who had access to which bank accounts, which could create a problem if someone left the company.

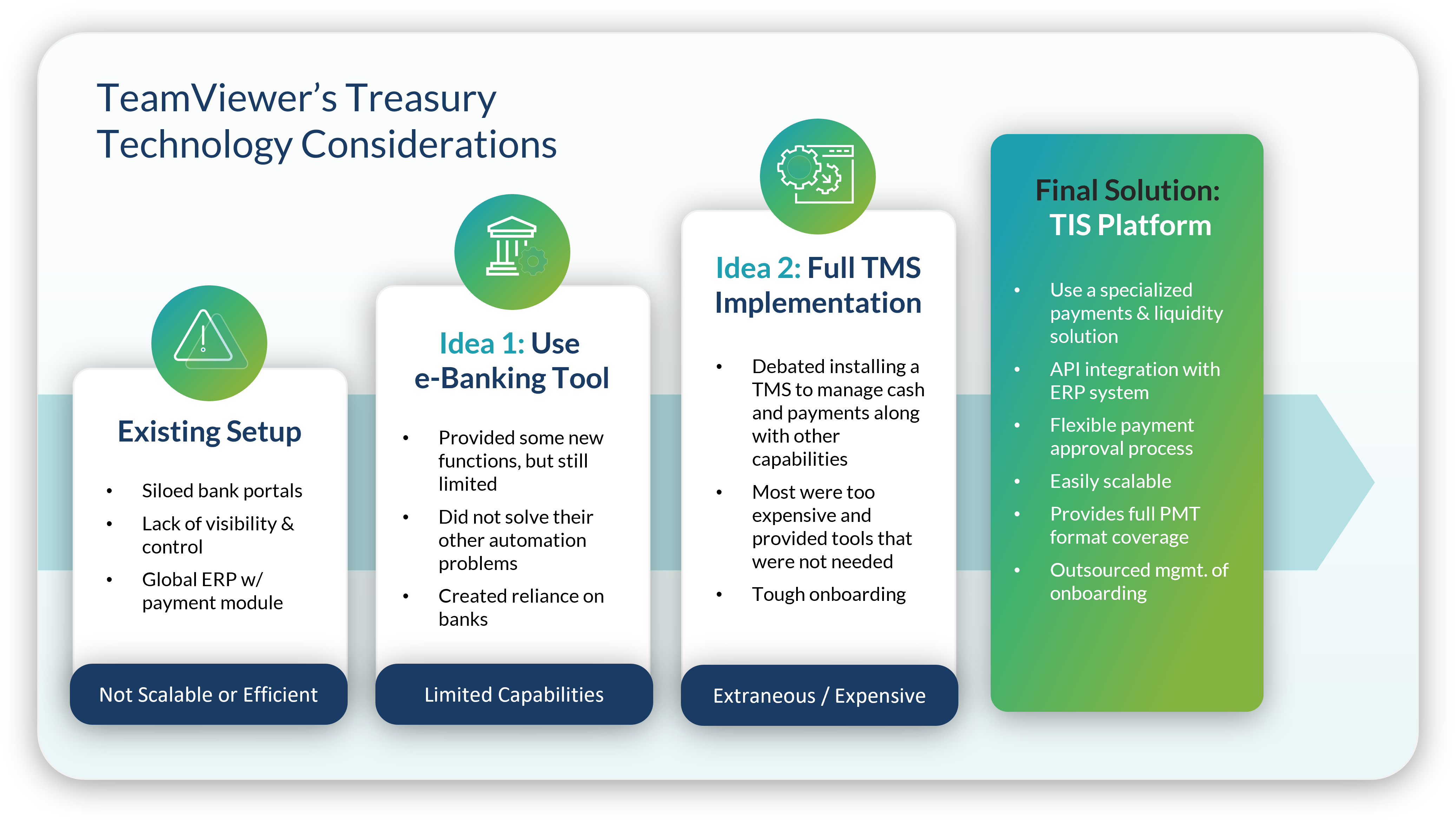

TeamViewer began looking for a new approach to cash positioning, liquidity management, bank account management, and payments that would streamline and automate processes which had always been manual, but would not be overly complex for Kießling and Mahringer. The company engaged a treasury consulting firm to help narrow the field of available solutions. After a formal request for proposals (RFP) process and a series of software demos, TeamViewer decided to deploy the TIS cash management platform.

“We were looking for a solution that would connect to all our banks around the world, as well as to TeamViewer’s internal systems,” Kießling says. “We were looking for quick, effective reporting on global cash positions and bank balances, and for a secure and fully compliant payment process. The flexibility to evolve with the company, and independence from IT, were also critical decision factors. We particularly liked the way that once TIS has developed a payment format for one customer in a particular country, the format becomes available for all TIS customers. So, we had a library of payment formats to choose from. We did not need the knowledge in-house for treasury-specific development work to create all the formats we required.”

Deployment of the software-as-a-service (SaaS) system required no customization or development work from TeamViewer’s IT group. Instead, the lean treasury team relied on TIS to set up EBICS connectivity with TeamViewer’s European banks, as well as to configure host-to-host and SFTP connections with the rest of TeamViewer’s international institutions. TIS also integrated the solution with TeamViewer’s new Microsoft Dynamics 365 enterprise resource planning (ERP) system. The entire project took about two years from start to finish, but the core functionality was working in around six months.

Today, Mahringer says, “there is one account in a very specific country where it is impossible to connect from the bank side. Otherwise, all our accounts are connected into the TIS system.” Kießling adds, “There are banks for which implementation was really easy, and there are banks where it was tricky. If we had known that one specific bank would have been so complicated to integrate with the TIS system, we might have changed banks before starting this project.”

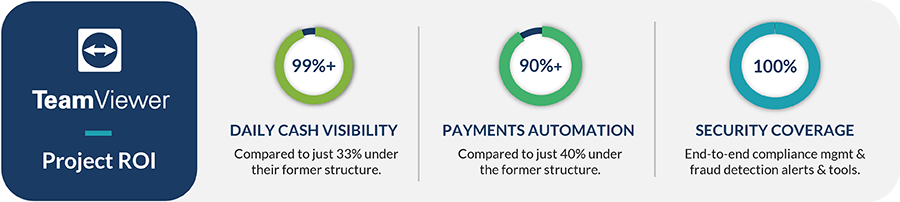

Payments generated in Microsoft Dynamics 365 now flow through the TIS system. The platform routes the payments to the appropriate people for approvals and signatures, per rules established by the treasury team, then transmits them to TeamViewer’s banks. All told, the efficiencies generated by the new processes have reduced the time Kießling and Mahringer spend on payments and cash positioning by about 75 percent.

Plus, Kießling says, “99 percent of our cash is visible in real time, versus about 33 percent previously.” This is crucial because of TeamViewer’s new status as a public company. “Now that we are listed, the CFO has higher expectations,” she continues. “When he asks, we need to know very quickly not only how much cash the company has, but where it is and in which currencies. And when something happens like the collapse of Silicon Valley Bank, he wants to know right away whether we have exposure to that particular institution—and if so, how much exposure we have.”

The new system and processes are benefiting functions beyond treasury, as well. “We have been able to bring all accounting and payments in-house, whereas before we outsourced some of those services in certain countries like Japan, China, and India,” Kießling says. “That is saving us money, and so is the fact that we now have a much better understanding of the wallet share we are giving to different banks. That helps us in negotiations with the banks we do more business with.”

The rest of the company now sees treasury as more strategic, “because we have more time for the rest of our workload,” Kießling adds. “In the past, we spent about 80 percent of our time on cash management and making sure all the transactions were in, so we had about 20 percent of our time for other activities. Now those numbers have flipped, and we have about 80 percent of our time for more strategic work.”

To learn more about this project and the benefits of the TIS solution, download the full TeamViewer project success story here.