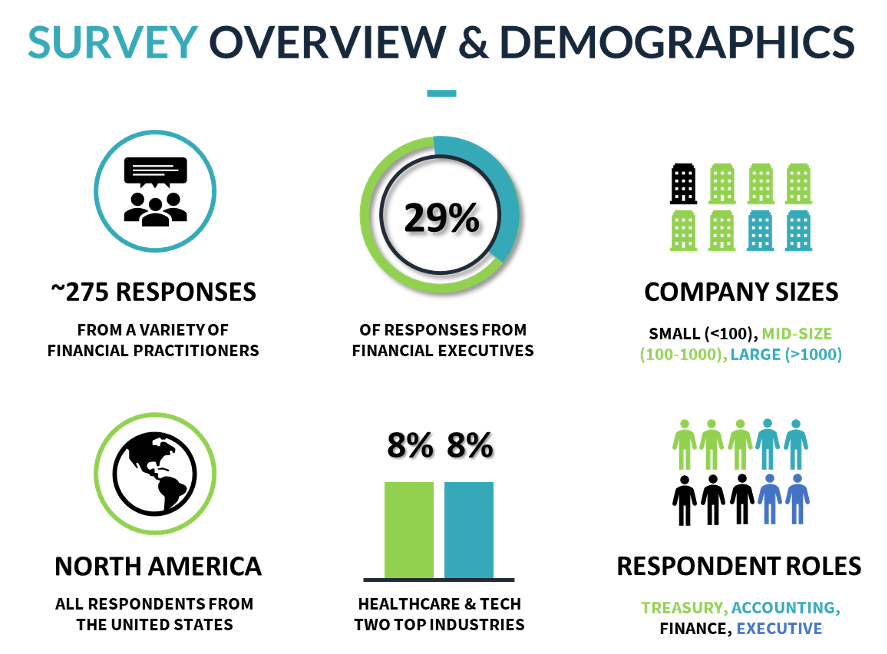

From Q4 2021 – Q1 2022, Treasury Webinars and Treasury Intelligence Solutions collaborated on a nationwide (U.S) treasury survey entitled: Treasury Priorities and Opportunities – A Look Ahead to 2022. The objective of this survey was to benchmark enterprise expectations for Treasury and analyze the scope of resources that treasury leaders will have to deliver on their expectations during 2022.

This cross-industry survey was launched in December of 2021 and focused on companies headquartered in the United States of America. We surveyed 273 participants with roles including Treasury Analyst, Treasury Manager, Assistant Treasurer, Finance Manager, VP of Finance, and CFO. The primary industries represented in the survey were Healthcare, Technology, Manufacturing, Construction, and Education.

This blog is based on the key results and benchmarks uncovered through the survey, and the insights contained herein are intended to help treasury leaders effectively lobby for the technology and personnel resources they need in order to deliver on expectations. This survey’s benchmarks and related insights will help empower companies to maximize the impact that their treasury departments have on the bottom line.

We hope you enjoy this precursor to our full survey report! To download the entire whitepaper, please click here.

Enterprise Perspectives on the Treasury Function

Before we begin evaluating treasury’s core priorities and opportunities in 2022, it is first helpful to review what transpired for most U.S. treasury teams during 2021.

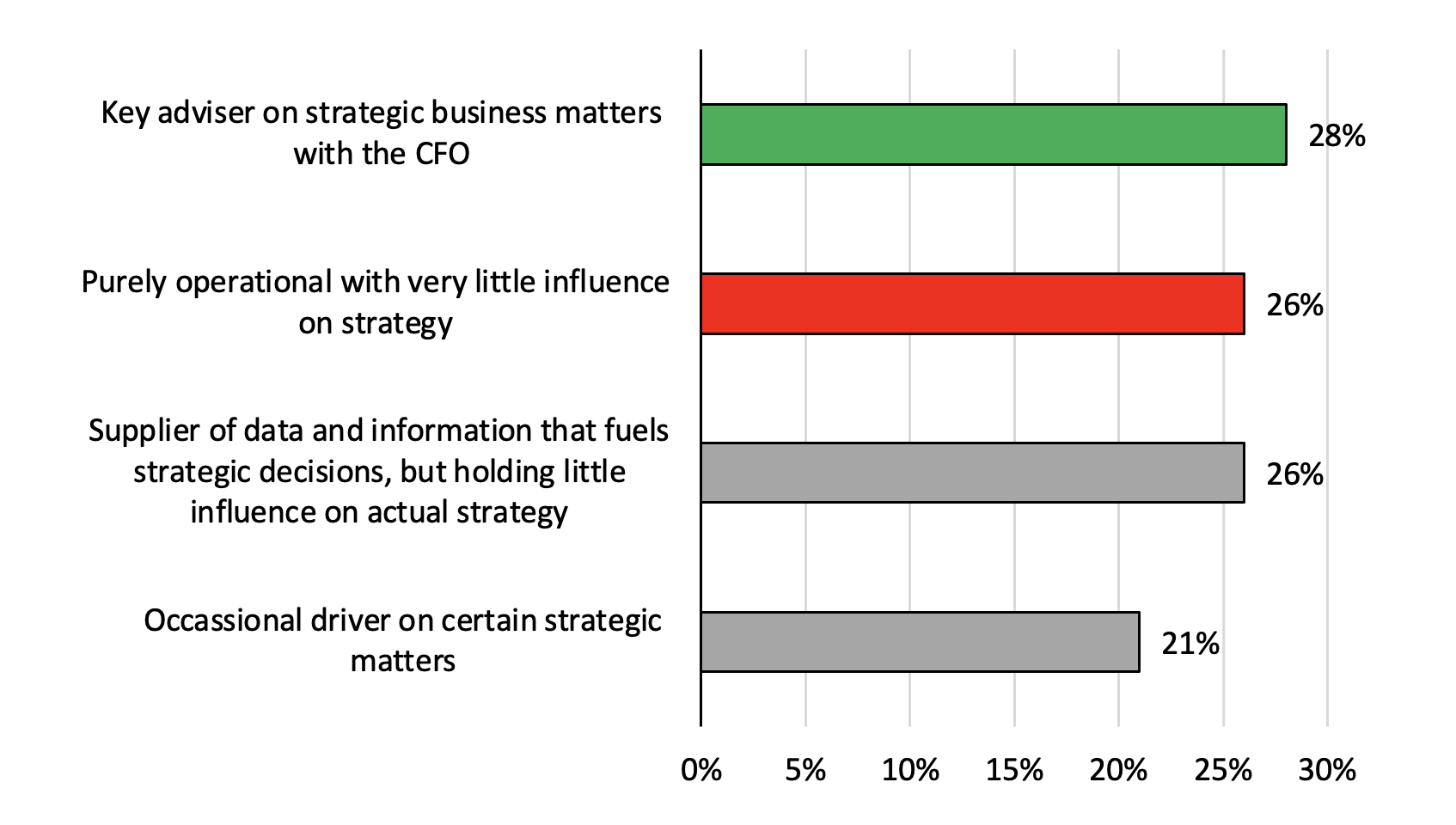

Not surprisingly, COVID has continued to put treasury teams squarely into the spotlight for CFOs. As a whole, managing cash, liquidity, payments, and risk has become even more critical, and it is encouraging to see that 28% of CFOs leverage treasury as a key advisor on strategic business matters, and another 26% look to treasury to supply data and/or reporting that fuels strategic decision making. However, over one-fourth (26%) of CFOs at the companies surveyed still view treasury as strictly a back-office function.

Enterprise Perspectives on Treasury’s Strategic Value

Breakouts by company size are available for the above chart in our full survey report.

Further analysis was conducted to evaluate how a CFO’s view of the treasury function shifted according to company size. Within the context of our survey, companies with <100 employees are classified as “small”, companies with 100 – 1,000 employees are “mid-market”, and companies with >1,000 employees are classified as “enterprise”.

What we discovered through this analysis is that the role of treasury at mid-market companies was significantly differentiated from teams at small and enterprise-sized companies. For example, only 12% of mid-market CFOs viewed treasury as a strategic partner, compared to 33% and 39% of small and enterprise CFOs. Elsewhere, 56% of mid-market companies indicated that treasury plays a primary role in data and operations, but holds little influence on strategy. This contrasts sharply with the 17% of small and 4% of enterprise respondents who shared this perspective.

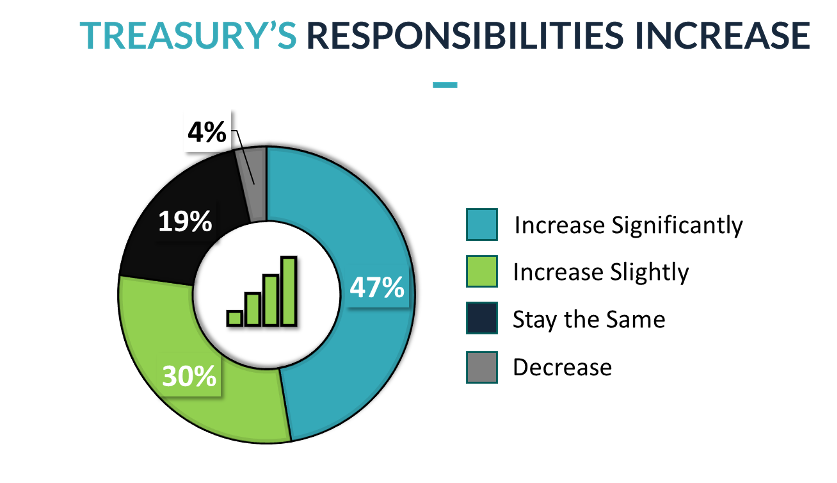

Despite some leaders still viewing treasury as holding little strategic value, there is no denying that treasury teams continue to play a greater role, collectively, within their respective companies. This assertion was supported by our survey results, as shown below, which highlight how departments will have much more responsibility in 2022. In fact, almost half (47%) of companies surveyed report that the responsibilities of their treasury teams will increase significantly in 2022, while another 30% of treasury teams will have a slight increase in responsibilities.

Breakouts by company size are available for the above chart in our full survey report.

Clearly, treasury teams are seeing a greater workload in 2022. However, the important question is whether this increase in responsibility results in a more strategic influence. For the majority of companies surveyed (60%), the answer is yes. In looking at the strategic role of treasury in 2022 by company size, the strategic role of treasury in 2022 is expected to grow for 60% and 61% of mid-market and enterprise companies, respectively.

To help assess the ability of treasury groups to deliver on these increased expectations, survey respondents were asked to identify the most important skillsets for their treasury team to improve in 2022. The skills that were most prioritized included cash management (49%), business partnering (44%), and data analytics (37%). These results are somewhat surprising because many areas that have proven problematic for treasury groups in the past did not seem to be a major concern to respondents. This included skills related to the use of emerging technologies (21%), as well as oral communication (12%).

To look deeper into these results, an analysis of the data was done relative to company size. The results clearly showed that data analytics will be most important to treasury teams at enterprise-sized companies, while cash management is king at small and mid-sized companies.

As a final follow-up, survey respondents were asked to identify the top hurdle their department would face as they work to meet departmental goals over the next 12-24 months. The results showed that budget constraints (33%) and a lack of IT resources (28%) were most frequently identified as the top obstacle. Only 23% of respondents identified the availability of finance/treasury staffing resources as a major hurdle. This indicates over 75% of companies are less concerned about the team/talent in place over the next two years to deliver on increasing expectations and are more concerned with the technology aspect of their situation.

Technology & Personnel Resources Available to Meet Expectations

To continue browsing the key findings from this survey report, download our full whitepaper. We hope you enjoy the findings, and thank you for reading.

Additional insights highlighted in our whitepaper:

- Treasury’s Personnel Resources Available to Meet Expectations

- Treasury’s Professional Training Priorities & Plans

- Treasury’s Technology Resources Available to Meet Expectations

- Treasury Perspectives on Emerging Technology Use Cases

- Key Survey Action Items & Implications

- Complete Survey Demographics

- Additional Breakouts by Company Size for All Key Metrics