This article is intended as a precursor to TIS’ latest whitepaper that highlights how CFOs can use their knowledge of the treasury function to spearhead initiatives that drive higher revenue, better financial decision making, and greater process automation and control. After reviewing how modern treasury groups typically operate, we will analyze the main benefits that a fully-optimized treasury team can provide to the CFO and an organization at large. To assess the full suite of data, insights, and commentary, download the whitepaper.

A CFO’s Summary of the Treasury Function

Although most CFOs will (or should) have a robust understanding of how the treasury function operates, let’s start with a quick synopsis for those who may be newer to the role.

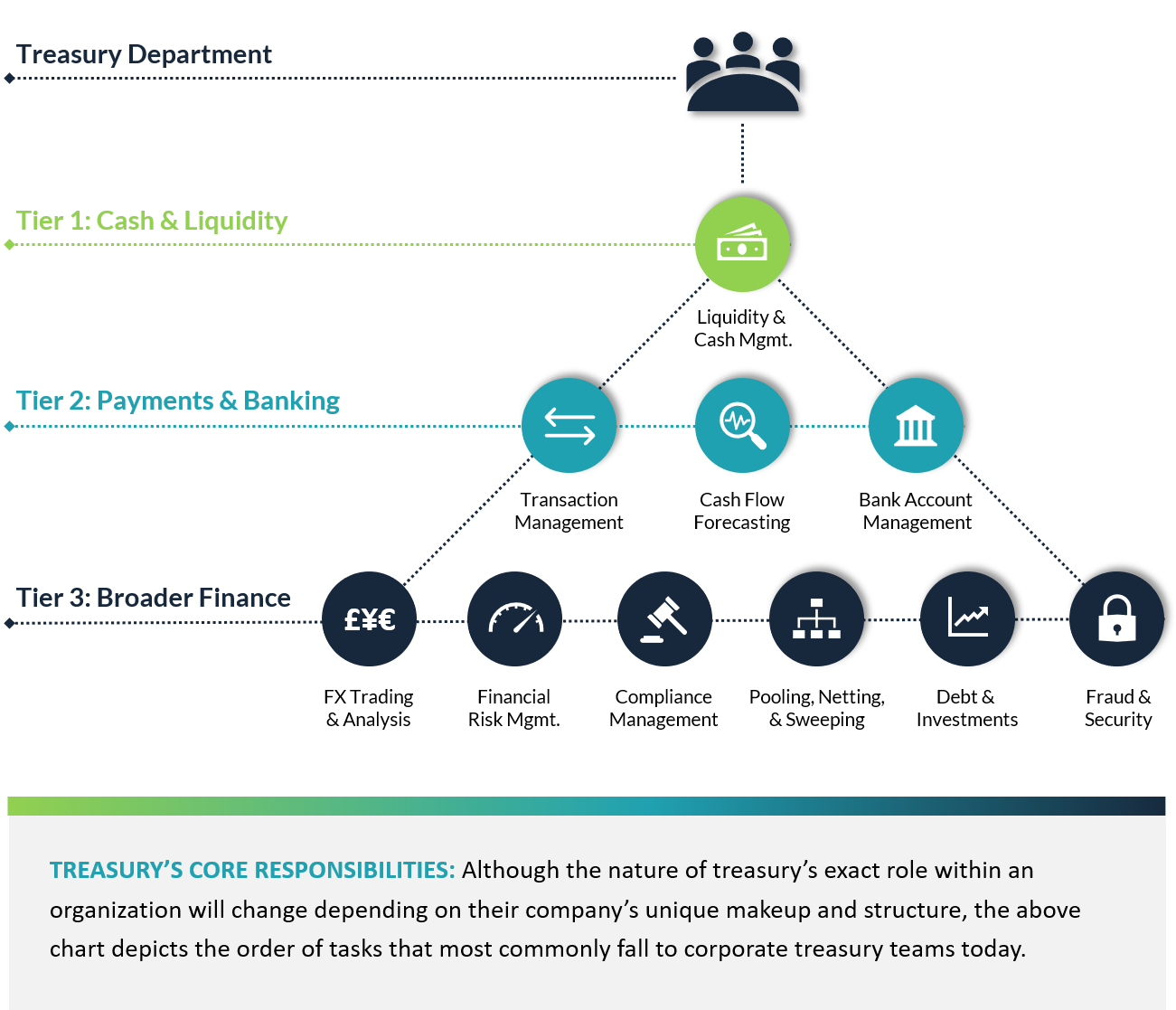

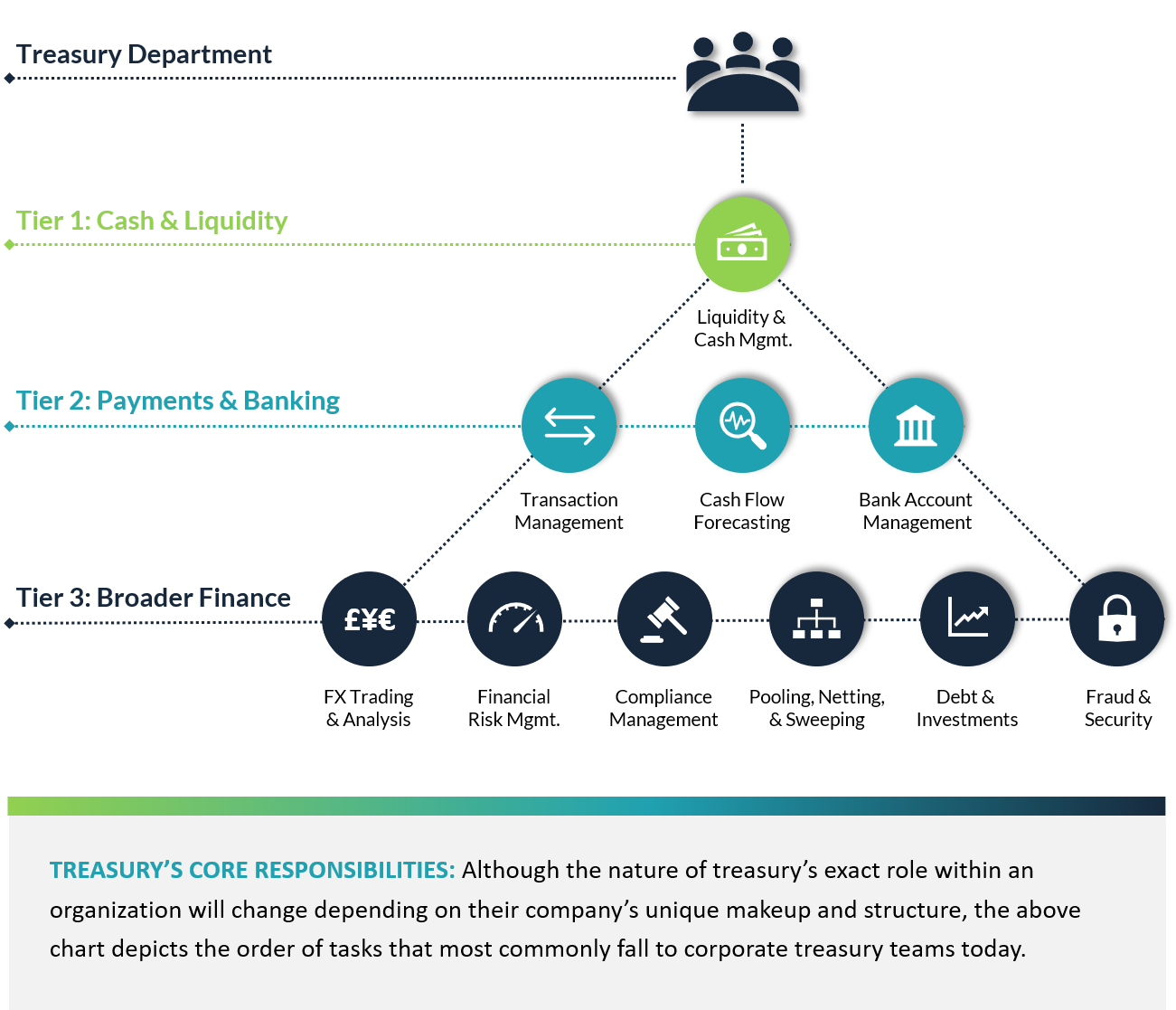

At the highest level, treasury is a subset of the finance department that is responsible for safeguarding their organization’s most important asset (cash) as well as providing transparency and control over the day-to-day processes necessary for the company to meet its financial obligations (i.e. payments). This means that at its core, the treasury function most commonly performs:

- Cash and liquidity management

- Payments and bank account management

- Financial Risk, Fraud, & Compliance Management

Of course, certain treasury teams will have additional duties levied onto them depending on the size, complexity, and structure of their organization. For instance, cash flow forecasting, FX trading, debt and investment activity, and cash pooling or netting are all functions that commonly fall under treasury’s purview, but it ultimately depends on the specific makeup of their organization.

Moving beyond these core roles, however, it’s also important to note that treasury groups, even those at multibillion-dollar, multinational companies, often consist of five or fewer individuals. In fact, data from 2020 showcased that the average treasury size for U.S. organizations, regardless of company size or complexity, was just four personnel. Further data from 2020 shows that the majority of these teams are accustomed to working remotely, with team members often located across entirely different regions and time zones.

But while treasury staffing might be kept to a minimum, the best teams still manage to optimize their processes by relying heavily on technology automation instead.

In order to function at the highest level, modern-day treasury teams utilize a variety of digital technologies that range from bank portals and Excel spreadsheets to cloud-based ERPs and TMS platforms, payment hubs, business intelligence solutions, and many other specialty systems. In 2021, the majority of solutions that treasury teams use are SaaS-based and connect via APIs with other SaaS solutions in their company’s environment, including other back-office solutions as well as external partner, vendor, and 3rd party platforms.

Thus, for organizations that are smart about their hiring decisions and that leverage finance and treasury technology in a strategic and efficient manner, even the smallest of treasury teams can excel at their roles and boost financial productivity.

However, on the opposite end, organizations that either ignore or underutilize their treasury group can end up with significant gaps in their financial processes, particularly from a payments, liquidity, and risk management standpoint.

Four Things Every CFO Should Know About Treasury

Download our latest whitepaper to gain additional data, graphics, and commentary!