About TIS’ Global Research

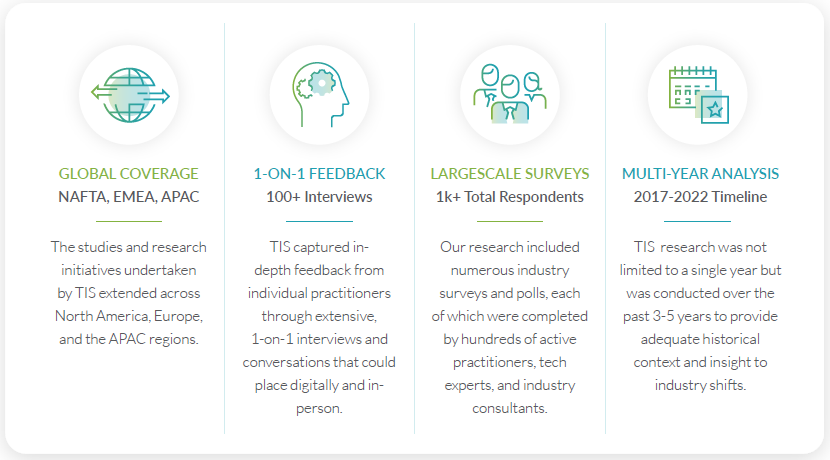

The insights highlighted in this article are based on a comprehensive set of studies conducted by TIS and our affiliates between Q1 2017 – Q2 2022. During this period, TIS held one-on-one interviews with hundreds of treasury experts and also released a suite of digital surveys that gathered feedback from thousands of financial practitioners regarding technology, staffing, and general operations.

Over the course of our research, TIS partnered closely with a niche team of industry experts, thought leaders, and consultants to interpret the findings. Historical treasury data was also obtained from the Association of Financial Professionals (AFP) and the consulting firm Strategic Treasurer to provide context regarding the evolution of treasury technologies and practices over time. Together, the expertise of our consortium and the extensive feedback collected from industry practitioners has provided us with unparalleled insights into the state of the treasury function in 2022.

While this article serves to highlight the summary findings and recommended action items from our studies, readers that would like more data and information are encouraged to download our full whitepaper for extended coverage.

Research We Relied Upon

The below surveys, polls, and interviews represent the full suite of research that TIS relied upon to complete our study. Links to the associated research conducted by our affiliates are provided as applicable.

- 2017 Strategic Treasurer Technology Use Survey. View Full Results Here

- 2020 AFP Strategic Role of Treasury Survey. View Full Results Here

- 2020 TIS Rapid Research: Remote Work Capabilities Poll

- 2022 TIS Rapid Research: Treasury & Payment Systems Usage Poll

- 2022 TIS & Treasury Priorities & Opportunities Survey. View Full Results Here

- 100+ One-on-One Interviews with Active Treasury Practitioners Between 2017-2022

Key Findings & Highlights

This section provides a brief overview of the key points obtained through our research. For more information on any point of interest, please refer to the full whitepaper.

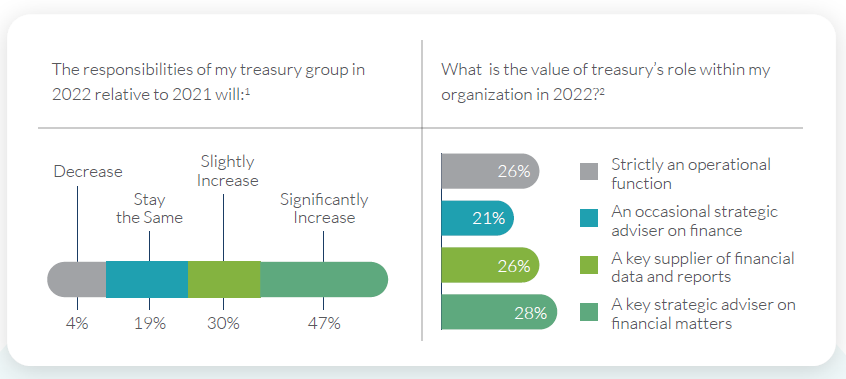

1. Treasury’s Responsibility List is Constantly Growing: The treasury function has never been more critical to the success of an organization, and this is being recognized internally by key stakeholders. However, treasury practitioners are now being handed additional responsibilities as executives and other departments realize the value they can provide, and nearly 80% of U.S. treasury teams saw their “net” list of responsibilities increase in 2022 vs 2021.

2. Stakeholders View Treasury as Equally Strategic & Operational: Over 50% of financial practitioners believe the treasury function holds key strategic value, which represents a significant shift from the traditional viewpoint of treasury being mostly an operational function. This shifting perspective is shared widely amongst internal stakeholders like accounting and AP. Today, treasury’s strategic influence is impacting areas like technology adoption, working capital management, bank connectivity, payment processing, and financial reporting.

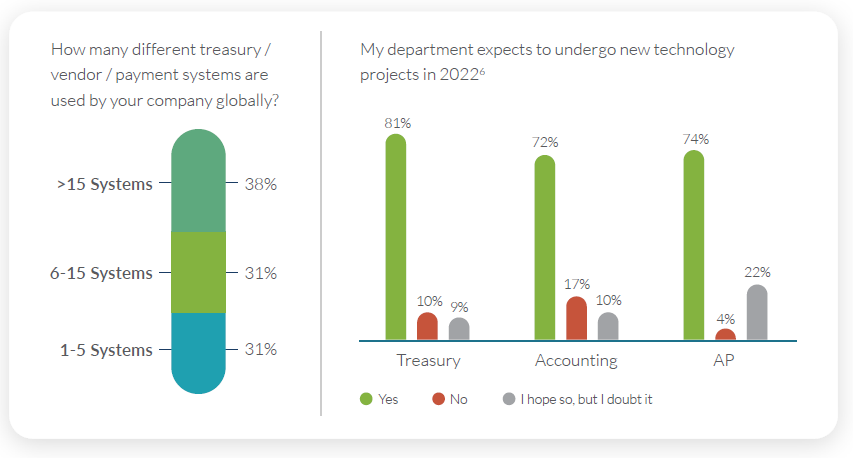

3. A Saturated Technology Market is Confusing for Treasury: The growing importance of the treasury function and widespread digitalization of global financial operations has resulted in an abundance of Fintech and bank-led software products entering the market. While this has helped foster innovation, data also shows that many treasurers have become confused by the breadth of categories and service offerings in the market, which has led to greater indecision and headache during RFPs and implementations.

4. The Line Between “Treasury Expert” and “Tech Expert” is Blurring: As the treasury function continues shifting away from paper-based and manual workflows to digitally automated processes and software tools, treasury personnel are finding that their technological proficiency has a significant impact on their ability to perform their core financial responsibilities. This is leading many practitioners to seek out technology-based learning courses in tandem with their more traditional financial education.

5. Fraud & Security Concerns Remain a Critical Issue: In today’s remote and digitally-operated business landscape, tech-savvy criminals are presented with even more opportunities for infiltrating a company’s systems and processes. This is leading to a noted increase in fraudulent attempts across a variety of areas, and treasury teams are continuing to invest heavily in both technology and training to protect themselves.

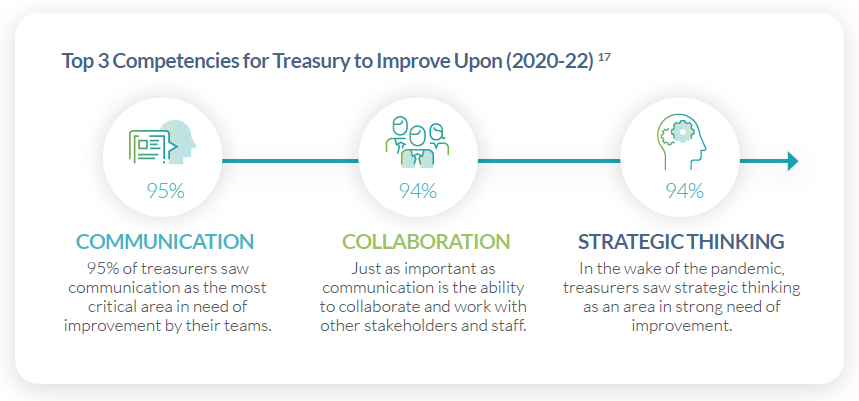

6. Successful Treasury Teams Collaborate with Other Stakeholders: Research found that many of the most successful treasury teams are proactively working cross-collaboratively with other internal stakeholders and departments like accounting, AP, and IT to accomplish their objectives. These teams are also frequently partnering with external consultants, solution vendors, and bank personnel to ensure alignment and cohesion across all their various systems and operational workflows.

Recommended Action Items for Treasury

Based on the findings from our research and interviews, TIS experts have compiled a short list of recommended action items that treasury teams should consider as they seek to better manage their operations in 2022 and beyond. They are as follows:

1. Embrace the Opportunity to Provide Greater Strategic Input: As CFOs and other departments increasingly rely on treasury for reliable data and insights, practitioners should embrace the opportunity to expand their strategic influence internally. In the long run, this ability to provide value in new ways across the organization will benefit treasury when it comes to securing new budget and staffing approvals. However, in order to provide the most visibility and control over their operations without overloading their small teams, treasury must become highly adept at leveraging technology to eliminate manual workflows and repetitive tasks.

2. Becoming Proficient with Technology Should be Non-Negotiable: As technology continues to play a massive role in treasury, it’s crucial for practitioners to familiarize themselves with the core tenets of the modern technology landscape. This does not mean simply researching new buzzwords, but instead seeking to understand the unique differentiators that separate various bank and fintech product offerings in the market. Treasury should also not hesitate to seek out the help of specialized consultants or technology experts for help. Ultimately, treasury’s ability to effectively identify the solutions and capabilities that best fit their company’s needs will save significant time, money, and headache during implementations and migrations.

3. Managing Security for Remote Workforces Requires Extra Care: Given the continued prominence of fraud attacks within the treasury and finance environment, there is no room for error when it comes to protecting a company’s systems, workflows, and personnel. To secure their funds and assets, treasurers must implement multifaceted security controls and protocols that extend beyond the “frontlines” and include executives, administrators, and other “back-office” staff. Combining education and awareness with multiple layers of technology is the only way to gain the upper hand against a new era of tech-savvy criminal.

4. Building Strong Relationships with Other Stakeholders is Crucial: Today, most of the financial systems and workflows that exist within a business are closely intertwined. This means that treasury operations have a significant impact on other departments, and vice versa. Given the extent to which treasury workflows are integrated with those of other stakeholders, it’s vital for treasury to communicate and collaborate effectively with these groups. To ensure total alignment and cohesion, treasurers must be proactive in establishing solid relationships with internal IT, accounting, and AP departments as well as external banking and solution vendors.

5. Ongoing Education is Vital for Staying Ahead of the Curve: Treasury and finance teams have made it clear they are intent on furthering their education and professional skillsets. This professional development is not limited to any one area but encompasses a broad array of topics across both technology and finance. In a digital world, many practitioners are relying on remote seminars and webinars, but in-person events and training are still on the list for many teams as well. Moving forward, it’s highly recommended that practitioners who are serious about their careers undergo regular education and training so that they can stay abreast of new industry developments and innovations.

How Can TIS Help?

The TIS team hopes that the findings highlighted in our research are helpful for teams currently evaluating their own treasury structure, technologies, and workflows. For businesses that view these insights and find themselves in need for enhanced payments, cash management, and banking functionality, we would strongly urge you to consider the solution and services provided by TIS.

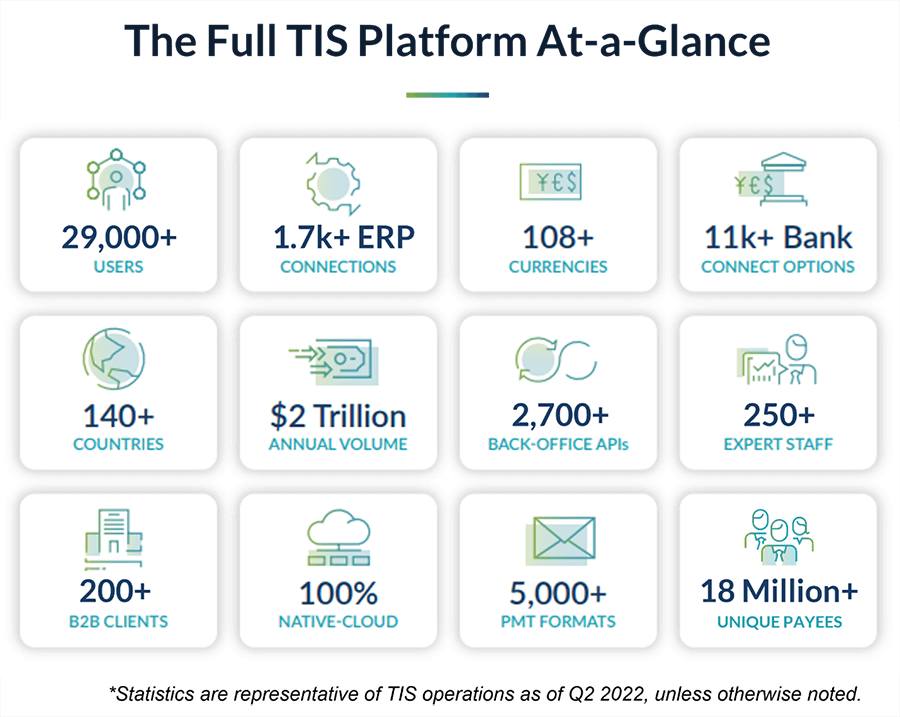

Today, TIS is streamlining treasury automation through a cloud-based platform that is uniquely designed to help global organizations optimize global payments and liquidity. In essence, the TIS solution is a multi-channel and multi-bank connectivity ecosystem that streamlines the processing of a company’s payments across all their global entities and systems.

Sitting above an enterprise’s technology stack and connecting with all its back-office, banking, and 3rd party solutions, TIS effectively breaks down department and geographic silos to allow 360-degree payments visibility and control. To date, the more than 200 organizations that have integrated TIS with their global ERPs, TMSs, and banking landscape have achieved near-real-time transparency into their payments and liquidity. This has benefited a broad variety of internal stakeholders and has also enabled them to access information through their platform of choice. Data is available either through dashboards or direct downloads but can also be delivered back to the originating systems.

As part of our client-centric service model, we fully commit our own resources to your implementation and manage the configuration of all required system functionalities, back-office integrations, and bank connections on your behalf. Beginning with project kick-off and lasting through testing and go-live, TIS’ all-inclusive approach to customer support means you never have to rely on internal resources to maintain our solution or integrate it with your existing technology stack.

This systematically controlled payments workflow is managed by TIS for both inbound balance information and outbound payments, and data can be delivered from any back-office system via APIs, direct plug-ins, or agents for transmission to banks and 3rd parties. No matter where you operate from, TIS provides global connectivity and provides the real-time data, control, and workflows needed for treasury to automate and control their end-to-end payments and liquidity processes.

For more information, visit our website or request a demo with one of our experts.