Secure global payments. Faster bank onboarding. Standardized payment processes.

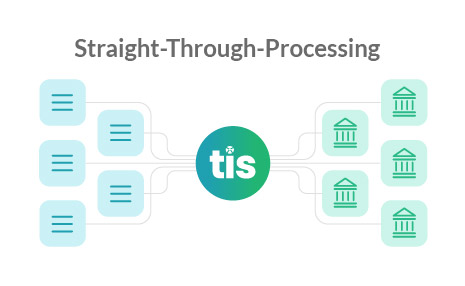

TIS centralized Payments Hub enables treasurers of multinational corporations to seamlessly navigate global payments complexity.

Choose a solution or keep scrolling

Global Payments Management

Manage your global payments operations from one centralized platform.

Connect to 11K+ global banks, control payment signees worldwide and execute all common payment types (SEPA, Card, ACH, Wire, Check etc.)

Automate, standardize, and simplify your payments workflows at a global scale.

End-to-end payment automation

Standardized payment workflows

Centralized payments oversight

Bank Connectivity

Connect banks with back-office systems – including ERPs, HR platforms, and TMSs – to provide company-wide access to global bank account and payment data.

Connect quickly to more than 11,000 banks globally via APIs, H2H, SWIFT, EBICS, and more, as well as regional clearinghouses and custom connection types.

Ensure compatibility with every financial messaging format, including ISO 20022, SWIFT MT, and other proprietary, bank-specific, or regional formats.

Workflow & Approval Management

Create standardized workflows to manage payment authorizations at a global, regional, and entity level.

Control user authorizations, roles, and rights directly from the system and compliantly add as many signers or approval designations to a workflow as required.

Rely on clear alerts, resolution management and an immutable audit log of user activity.

Standardized approval structures

Centralized user management

Simplified reporting of user activity

Fraud Prevention & Detection

Screen payments at the critical entry points for fraud and receive real-time alerts of unusual payments from both internal and external sources.

Leverage aggregated payment data from across the TIS trusted community of global enterprises and bank partners to identify inconsistencies.

Validate third party bank accounts and prevent payments to the wrong party.

Global Sanctions Screening

Stay compliant with the TIS sanction screening solution and real-time updates.

Manage global sanctions screening from one centralized platform.

Adhere to the relevant global watch lists (e. g. OFAC, UN, EU) as well as customizable blocklists and allow lists.

24/7 automatic payments monitoring

Full sanctions compliance

Avoid non-compliance penalties

US B2B Payments Orchestration

Evaluate your supplier network and determine the most effective option for completing transactions (i.e. check, ACH, wire, or virtual card).

Manage activity through a single payment instruction file.

Earn rebates through our Partner Program.

Cross-Border Payment Management

Execute payments across more than 140 currency options and 175 local market exchanges.

Avoid expensive FX fees and unfavorable exchange rates incurred when initiating international payments.

Gain full control of payments execution schedules and exchange rates.

FX savings

Payments execution efficiency

Faster cross-border payments

Payment Platform Security

Monitor user actions, receive automatic alerts of suspicious activity, and easily audit user activity at any time.

Stay protected with multi factor authentication (MFA), single sign-on (SSO), IP safe-listing, block-listing protocols, biometric scans and personally customizable PINs.

Trust a fully certified payments partner with the highest level of data security (SOC1 & SOC2, ISO 27001, TISAX, SWIFT, SAP certifications, and more).