As a treasury or finance professional, tracking the full spread of payments evolution happening in today’s fast-paced business environment is almost impossible to manage on your own. Between the broad range of payments activity that occurs within organizations and the diversity of payment options that exist, there may be thousands of micro–evolutions occurring at any one time.

However, taking a giant step back and looking at macro trajectories, perhaps the best way to understand ongoing evolution is by referring to it as the “digitization” of payments workflows.

Understanding the Digitization of Corporate Payments

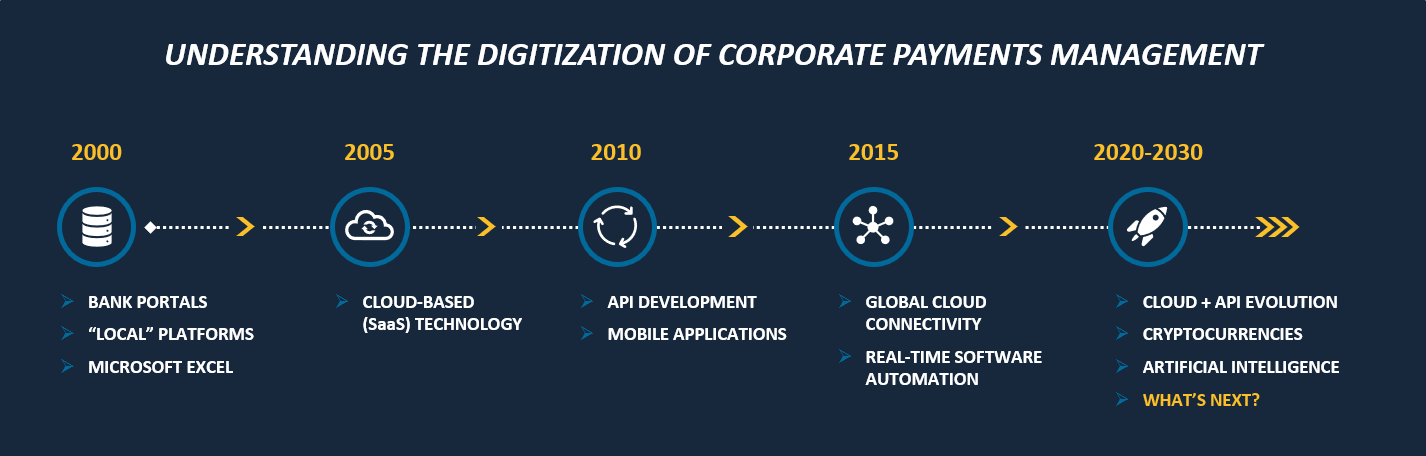

Historically, almost every significant shift in corporate payments has involved the use of new technologies. For instance, the arrival of banking portals, which enabled companies to electronically initiate transactions with their bank, helped drive the replacement of physical cash and checks by ACH, SEPA, and wire payments. The sustained development of fintech payment solutions, cloud technology, and mobile payment applications has helped democratize this shift even more. And most recently, the creation of fully digital or “crypto” currencies like Bitcoin and Ethereum have introduced an entirely new form of transacting.

Now, as we enter a new decade, many are wondering where the next major shift in corporate payments will occur. Is the media hype surrounding Bitcoin and Blockchain to be believed? Will artificial intelligence (AI) completely transform how payments are managed? Or are there more substantial developments that are simply not garnering “mainstream” coverage?

Our perspective?

Although developments surrounding cryptocurrency and AI must be taken seriously, most of these newer technologies are still in their relative infancy. However, recent conversations with many treasury practitioners have shown us that the most meaningful forms of payment digitization happening today are not related to the use of newer, “disruptive” technologies, but to the continued democratization and enhancement of existing applications for cloud (SaaS) technology and application programming interfaces (APIs).

Let’s dig into this a bit further.

Why are Cloud Solutions & APIs so Essential for Payments Automation?

Recently, a study of U.S. treasury groups found that by 2024, over 2/3rds of companies would be using cloud-based treasury and payments management solutions. Another 51% would be using API-enabled treasury solutions.

The logic behind this trend is simple.

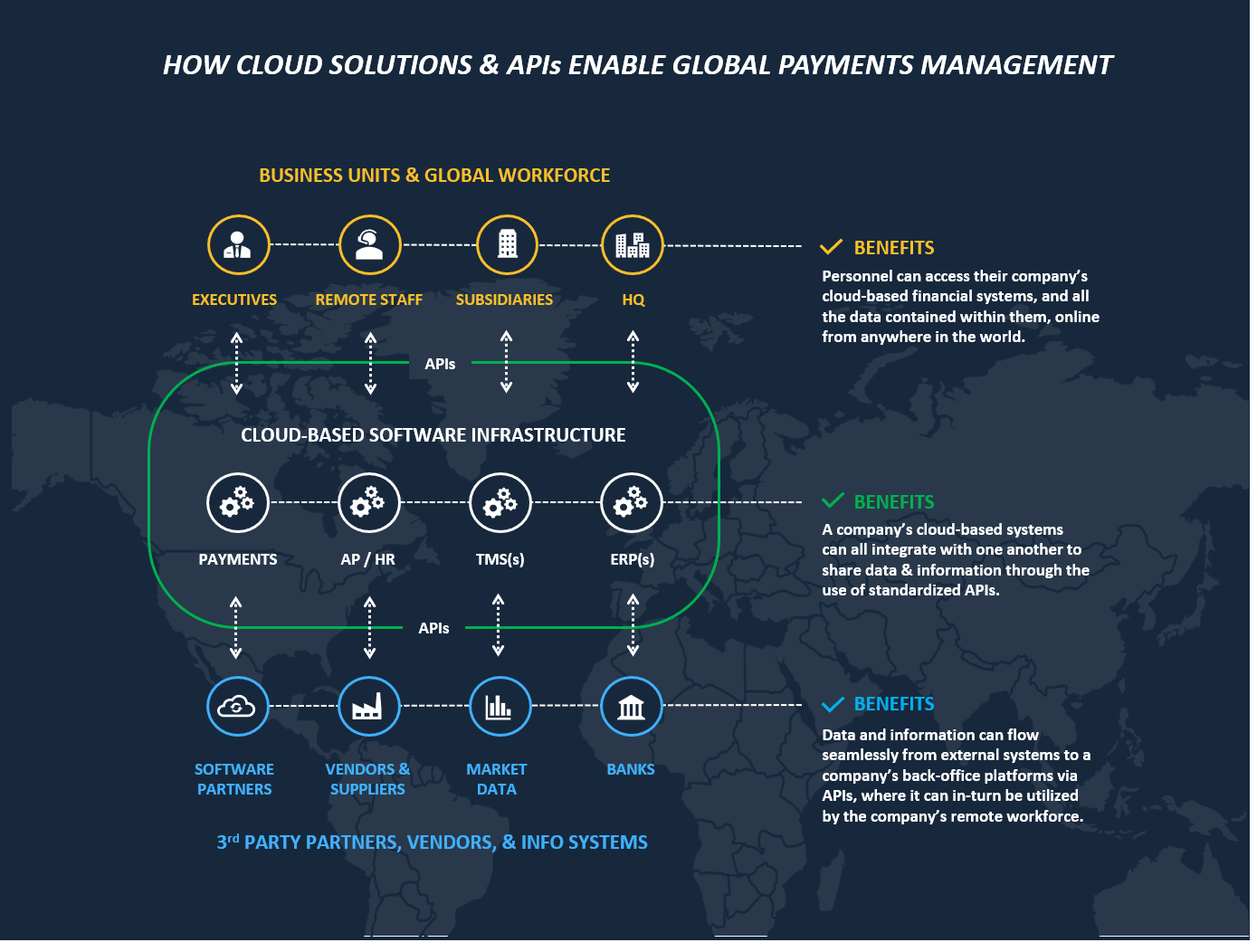

With cloud technology, organizations are no longer confined to “on-premise” hardware. Hosting payment solutions online and “in–the–cloud” means that as long as employees and executives have a secure internet connection, they can access the software from any location globally. There are no geographic or operational constraints, which makes it more flexible and cost-effective to deploy for multinational companies and is ideal for remote work. And, system updates and patches can be automatically performed by the vendor, which results in more up-time.

But while these components of cloud technology are hugely beneficial on their own, the use of standardized APIs for communication across cloud platforms has made way for even greater transformation. With APIs, all of an organization’s “back-office” cloud solutions (e.g. ERP, TMS, AP, HR, payment hub) can communicate with one another and share data. Third-party cloud solutions managed by market data providers, fintech vendors, and certain banks can all integrate via APIs as well.

This API integration is important because it enables cross-platform data transmission and process execution to occur without explicit human commands.

Because APIs act as a programming “language” that is spoken and understood between systems, developers can create API logic to perform cross-platform tasks such as transmitting data, submitting payments, and more. And once the proper API is enabled, all an organization’s platforms will communicate with each other to complete the function requested by the API.

Where treasury is concerned, APIs can be configured to pull statements and data from a company’s banking platforms into a centralized payment solution. Then, APIs can be used to transmit the data from this payment solution into a TMS, ERP, or HR system for further analysis. Going a step further, APIs may also be used to submit payment requests from an ERP or TMS to a centralized payment hub for transmission to banks, thereby automating both payment execution and subsequent cash reporting.

In practice, the API logic to support these data streams only needs to be configured once, and then payments data will begin flowing automatically between the systems moving forward without any manual or “human” effort.

Given the ease at which manual and repetitive workflows can be automated with APIs and cloud technology, treasury and finance teams are able to streamline time-consuming functions and spend more time focusing on analysis and strategy.

Few people understand the impact of this shift as much as TIS’ Co-founders, Joerg Wiemer and Erol Bozak.

Firsthand Experience: Navigating the Complexity of Global Payments

At the start of 2000, Joerg Wiemer was the SVP and Head of Treasury for SAP®, a company with over $2.5 billion in global assets. As part of this role, Joerg had direct responsibility over SAP®’s global payments strategy. At the same time, Erol Bozak was serving as a lead architect for SAP®’s newly-formed cloud services division and had a major role in shaping the functionality that was being deployed for SAP®’s clients around the world.

For Joerg, the task of managing payments across dozens of banks and thousands of accounts, often without daily or even weekly visibility to his cash balances, was a source of constant headache.

For one, nearly every payment generated by his department had to be entered, approved, and executed manually. And despite SAP®’s prominent use of electronic payment methods, it could take days to receive confirmation that certain transactions had posted. This was due primarily to a lapse in communication between SAP®’s internal systems, which were not yet cloud-based, and the systems in place at the various banks and vendors that SAP® transacted with. Because these systems could not effectively integrate with one another and because there were numerous points in the payment process that required manual input, the entire process was drawn out.

Erol also saw these inefficiencies play out for many of the corporate clients that he was working with, particularly those with high volumes of international transactions. Both he and Joerg recognized that the end-to-end payment process was too disjointed, and both believed that a new wave of technological innovation was needed to drive greater automation and control.

After getting to know each other through an EMBA program, Erol and Joerg realized they shared the viewpoint that cloud technology could revolutionize corporate payments and cash management. Given the advancements in automation and connectivity that SaaS technology provided, their vision was to create a cloud-based payment platform that enterprises could use to manage transactions and achieve visibility to their cash balances in any bank, in real-time, globally. What they wanted was pure automation of corporate payment workflows, and they believed that a globally interconnected web of cloud solutions could provide just that.

Fast forward to 2021, and Erol and Joerg remain on the frontlines of treasury, cloud, and API innovation as the co-founders of TIS. With over 160 multinational corporates leveraging their technology to automate payments and cash management workflows, they continue to see firsthand how sustained improvements to API and cloud technology are transforming the treasury and finance functions.

Cloud Solutions & APIs Will Continue Transforming Payments

As we survey the corporate payments landscape in 2021, it feels safe to suggest that companies today should never settle for having to manually execute their payments or get by without real-time visibility to their transactions and cash balances. It does not matter how many banks your organization uses, how many payments you send, or where your vendors, employees, and subsidiaries are located. If you and your partners are leveraging modern cloud software and API solutions the right way, all of your company stakeholders can automate their payment processing, implement controls for identifying fraudulent or non-compliant transactions, and maintain complete transparency over their global liquidity and cash movements. If this is not your reality today, perhaps it is time to reevaluate your solution architecture.

Looking ahead to the next ten years, it is clear there is more change on the horizon. From the slow but steady permeation of cryptocurrency to the growing prominence of AI solutions, the payments landscape is always evolving. However, one thing that has become abundantly clear is that cloud technology is only now beginning to its their full potential. Such solutions are not a “trend”, and their value will not be diminished in the next few years. Cloud technology and APIs are still actively transforming corporate payments and cash management, and if any company has yet to fully embrace the importance of this shift, the threat of being leap-frogged is looming large.